Pandian targets Pradhan, seeks people’s support to keep development work going

Jeypore: Chief Minister Naveen Patnaik's close aide and senior leader Kartik Pandian Thursday launched a scathing attack on the opposition BJP and Congress leaders accusing them of opposing Odisha government's welfare schemes and politicising development work. Addressing two election rallies...

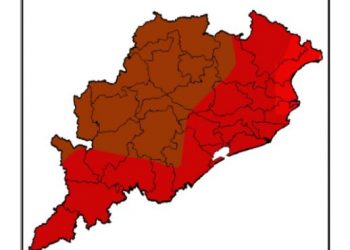

IMD issues red alert as Odisha reels under severe heatwave, mercury to rise further

Bhubaneswar: Odisha reeled under severe heatwave conditions Thursday with Jharsuguda recording the maximum temperature of 43.8 degrees Celsius, officials said. Baripada sizzled at 43.6 degrees Celsius, followed by Nuapada (43.5), Talcher (43.4), and Boudh (43.2). Kendrapara, Cuttack and Bolangir town...

Maximum poor people live in Odisha, BJD govt needs ouster for state’s development: Shah

Heatwave conditions persist in Odisha due to climate over Pakistan, Afghanistan: CEC

Odisha: Man sentenced to 20 years RI by POCSO court for raping minor

EC seeks BJP, Congress’s responses on charge of PM Modi, Rahul Gandhi violating model code

New Delhi: Taking cognisance for the first time of a model code violation allegation against a prime minister, the Election Commission Thursday asked the BJP to respond to complaints filed by opposition parties wherein they have accused Prime Minister Narendra Modi of delivering a divisive and defamatory speech in Rajasthan's...

Read morePatidar, spinners help RCB snap six-match losing streak

Hyderabad: Rajat Patidar's explosive fifty and a collective effort from the spinners set up Royal Challengers Bengaluru's 35-run win over Sunrisers Hyderabad in the IPL here Thursday, bringing an end to their six-match losing streak. Patidar's 50 off 20 balls stood in stark contrast to Virat Kohli's measured 51 off 43 balls as RCB put up 206 for seven after opting to bat. For a team that has breached the 250-run...

Read moreSC to pronounce verdict on pleas seeking cross-verification of votes cast using EVMs with VVPAT

New Delhi: The Supreme Court is scheduled to pronounce its verdict Friday on a batch of pleas seeking complete cross-verification of votes cast using EVMs with Voter Verifiable Paper Audit Trail, or VVPAT. A bench of Justices Sanjiv Khanna and Dipankar Datta is likely to pronounce the verdict. The top court had Wednesday said it cannot "control the elections" or issue directions simply because doubts have been raised about the efficacy...

Read moreUS imposes sanctions on three Indian companies for trade and ties with Iran

Washington: The United States slapped Thursday sanctions on over a dozen companies, individuals and vessels, including three from India, for facilitating illicit trade and UAV transfers on behalf of the Iranian military. The US Department of Treasury said these companies, individuals and vessels have played a central role in facilitating and financing the clandestine sale of Iranian unmanned aerial vehicles (UAVs) to Russia's war in Ukraine. While Sahara Thunder has been...

Read moreSection of judiciary collaborating with BJP to fix orders: Abhishek

Tamluk: Senior TMC leader Abhishek Banerjee Thursday accused a section of the judiciary of collaborating with the BJP to "fix orders" in alignment with the party's political agenda. Earlier this week, the Calcutta High Court declared the recruitment process of the State Level Selection Test-2016 (SLST) in West Bengal government-sponsored and aided schools as "null and void," ordering the cancellation of all appointments made through it. Speaking to reporters in Tamluk,...

Read moreFeatured

Trending

More Top Stories

Patidar, spinners help RCB snap six-match losing streak

Hyderabad: Rajat Patidar's explosive fifty and a collective effort from the spinners set up Royal Challengers Bengaluru's 35-run win over Sunrisers Hyderabad in the IPL here Thursday, bringing an end to their six-match losing streak. Patidar's 50 off 20 balls stood in stark contrast to Virat Kohli's measured 51 off 43 balls as RCB put up 206...

SC to pronounce verdict on pleas seeking cross-verification of votes cast using EVMs with VVPAT

New Delhi: The Supreme Court is scheduled to pronounce its verdict Friday on a batch of pleas seeking complete cross-verification of votes cast using EVMs with Voter Verifiable Paper Audit Trail, or VVPAT. A bench of Justices Sanjiv Khanna and Dipankar Datta is likely to pronounce the verdict. The top court had Wednesday said it cannot "control...

Pandian targets Pradhan, seeks people’s support to keep development work going

Jeypore: Chief Minister Naveen Patnaik's close aide and senior leader Kartik Pandian Thursday launched a scathing attack on the opposition BJP and Congress leaders accusing them of opposing Odisha government's welfare schemes and politicising development work. Addressing two election rallies held at Pottani and Laxmipur assembly segments under Koraput parliamentary constituency, Pandian highlighted Chief Minister Naveen Patnaik's...

Deeply biased: MEA on US report citing human rights violations in India

New Delhi: India Thursday described a US State Department report citing alleged incidents of human rights violations including in Manipur as "deeply biased" and said it reflects a poor understanding of India and it attach no value to it. The annual report of the State Department highlighted instances of human rights abuses in Manipur following the outbreak...

US imposes sanctions on three Indian companies for trade and ties with Iran

Washington: The United States slapped Thursday sanctions on over a dozen companies, individuals and vessels, including three from India, for facilitating illicit trade and UAV transfers on behalf of the Iranian military. The US Department of Treasury said these companies, individuals and vessels have played a central role in facilitating and financing the clandestine sale of Iranian...

IMD issues red alert as Odisha reels under severe heatwave, mercury to rise further

Bhubaneswar: Odisha reeled under severe heatwave conditions Thursday with Jharsuguda recording the maximum temperature of 43.8 degrees Celsius, officials said. Baripada sizzled at 43.6 degrees Celsius, followed by Nuapada (43.5), Talcher (43.4), and Boudh (43.2). Kendrapara, Cuttack and Bolangir town recorded a maximum of 43 degrees C, according to the Meteorological Centre at Bhubaneswar. A red alert...

Italian PM Meloni invites PM Modi to G7 Summit Outreach Session in June

New Delhi: Prime Minister Narendra Modi has received an invitation from his Italian counterpart Giorgia Meloni to attend the G7 Summit Outreach Session in Italy in June. Modi spoke to Italian Prime Minister Meloni Thursday and thanked her for the invite to the G7 Summit Outreach Sessions to be held in Italy's Puglia, the Ministry of External...

Section of judiciary collaborating with BJP to fix orders: Abhishek

Tamluk: Senior TMC leader Abhishek Banerjee Thursday accused a section of the judiciary of collaborating with the BJP to "fix orders" in alignment with the party's political agenda. Earlier this week, the Calcutta High Court declared the recruitment process of the State Level Selection Test-2016 (SLST) in West Bengal government-sponsored and aided schools as "null and void,"...

Maximum poor people live in Odisha, BJD govt needs ouster for state’s development: Shah

Sonepur: Alleging that the maximum number of poor people live in Odisha despite the state being mineral-rich, Union Home Minister Amit Shah Thursday urged the people to oust the Naveen Patnaik-led BJD government in the election. Shah said this while launching the BJP's election campaign in Odisha here at Sonepur under Bolangir Parliamentary Constituency in the western...

Patidar, Kohli make contrasting fifties to take SRH to 206/7

Hyderabad: Rajat Patidar's explosive innings stood in stark contrast to Virat Kohli's measured approach as Royal Challengers Bengaluru put up 206 for seven against Sunrisers Hyderabad in the IPL here Thursday. Patidar (50 off 20 balls) did the bulk of the work in his 65-run stand with Kohli (51 off 43) who was focused on giving the...