Naveen contesting from western Odisha to help BJD in several seats, feels party

Mercury soars to 40 deg C at 30 places in Odisha

ECoR to run 20 pairs of summer special trains

Two killed in road mishap during Ram Navami procession in Odisha

Odisha: NHRC seeks ATR on forcible displacement of villagers

Kendrapara: National Human Rights Commission (NHRC) has sought an action taken report (ATR) from the Principal Secretary of the Department of Water Resources of the Odisha government and the Sundergarh district administration regarding the lack of rehabilitation measures for villagers...

Campaigning ends for first phase of Lok Sabha polls in 102 seats

New Delhi: Campaigning ended Wednesday evening for 102 Lok Sabha seats across 21 states and Union territories which will go to polls in the first phase April 19 with top leaders of the BJP-led NDA and the opposition INDIA bloc making a last-gasp effort to woo voters. Leading the charge,...

Read moreDelhi Capitals beat Gujarat Titans by 6 wickets

Ahmedabad: Delhi Capitals defeated Gujarat Titans by six wickets in a lop-sided IPL match here Wednesday. Opting to field, DC bowled out former champions GT for a meagre 89 and then came back to overhaul the target, scoring 92 for four in 8.5 overs. Jake Fraser-McGurk (20), Shai Hope (19) and Rishabh Pant (16 not out) all played cameos to take the team home. Earlier, it was a batting capitulation for...

Read moreEC advises West Bengal Guv against visiting Cooch Behar as it violates model code: Sources

Kolkata: Taking a tough stance, the Election Commission has advised the West Bengal governor to call off his proposed tour of Cooch Behar on the eve of the Lok Sabha polls' first phase as it was violative of the Model Code of Conduct, sources said Wednesday. Polling is scheduled in Cooch Behar April 19 and the 48-hour silence period when campaigning is barred begins Wednesday evening. Having come to know of...

Read moreCongress questions EC on getting social media post on electoral bonds deleted

New Delhi: The Congress Wednesday questioned the Election Commission's move to get a post on electoral bonds scheme deleted from social media platform X and said that the issue raised in the post makes the government "extremely uncomfortable". The opposition party's remarks came after the social media platform X said that the Election Commission ordered it to take down select posts of YSR Congress, AAP, N Chandrababu Naidu and Bihar Deputy...

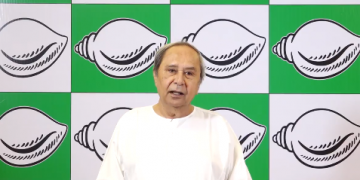

Read moreBJD announces fresh candidates’ list, CM Naveen Patnaik to contest from two seats

Bhubaneswar: BJD president and Odisha Chief Minister Naveen Patnaik will also contest from Kantabanji assembly constituency in Bolangir district of Western Odisha along with his traditional Hinjili seat in Ganjam district. This was announced by Patnaik himself Wednesday while releasing the 5th list of nine candidates for the Assembly elections in the state. Patnaik in 2019 assembly elections had also contested from two seats. He won from both Hinjili and Bijepur assembly...

Read moreFeatured

Trending

More Top Stories

Naveen contesting from western Odisha to help BJD in several seats, feels party

Bhubaneswar: Odisha Chief Minister Naveen Patnaik's selection of the Kantabanji Assembly segment as the second seat, besides his traditional Hinjili constituency, will have a positive effect on the ruling Biju Janata Dal in the western part of the state, according to a senior BJD leader. The regional party, which has a strong support base in coastal, central,...

Delhi Capitals beat Gujarat Titans by 6 wickets

Ahmedabad: Delhi Capitals defeated Gujarat Titans by six wickets in a lop-sided IPL match here Wednesday. Opting to field, DC bowled out former champions GT for a meagre 89 and then came back to overhaul the target, scoring 92 for four in 8.5 overs. Jake Fraser-McGurk (20), Shai Hope (19) and Rishabh Pant (16 not out) all...

Mercury soars to 40 deg C at 30 places in Odisha

Bhubaneswar: Entire Odisha is reeling under intense heat wave conditions with the temperature touching 40 degrees Celsius in at least 30 places in the state Wednesday. Coal town Talcher in Angul district recorded the state's highest temperature of 43.2 deg C while the mercury crossed the 41 deg C mark for the first time this summer at...

ECoR to run 20 pairs of summer special trains

Bhubaneswar: The East Coast Railway (ECoR) has decided to run 20 pairs of special trains in its jurisdiction towards different destinations of the country to clear additional rush in regular trains during summer. ECoR sources said, nine more pairs of Special Trains will be added to avoid Summer rush while the services of 11 Pairs of Special...

Two killed in road mishap during Ram Navami procession in Odisha

Rourkela: Two youths were killed after their motorcycle collided with a truck during a Ram Navami procession in Odisha's Sundergarh district Wednesday, police said. The deceased were identified as Bastab Majhi (17) and Abhimanyu Baa (18) of Subdega area in the district. The incident occurred near a petrol pump at Tumulia under the jurisdiction of Talsara police...

Campaigning ends for first phase of Lok Sabha polls in 102 seats

New Delhi: Campaigning ended Wednesday evening for 102 Lok Sabha seats across 21 states and Union territories which will go to polls in the first phase April 19 with top leaders of the BJP-led NDA and the opposition INDIA bloc making a last-gasp effort to woo voters. Leading the charge, Prime Minister Narendra Modi took whirlwind tours...

Odisha: NHRC seeks ATR on forcible displacement of villagers

Kendrapara: National Human Rights Commission (NHRC) has sought an action taken report (ATR) from the Principal Secretary of the Department of Water Resources of the Odisha government and the Sundergarh district administration regarding the lack of rehabilitation measures for villagers displaced due to the construction of Rukuda Dam in Sundargarh district. The NHRC has requested the ATR...

Delhi Capitals bundle out Gujarat Titans for 89

Ahmedabad: Opting to field, Delhi Capitals bowled out former champions Gujarat Titans for a meagre 89 in their IPL match here Wednesday. It was a batting capitulation for GT as Rashid Khan emerged as the top-scorer with a 24-ball 31. Sai Sudharsan (12) and Rahul Tewatia (10) were the only other batters to reach double figures. This...

Odisha: Today’s Pics

Hot and humid day in Bhubaneswar Ram Navami celebrated at Manas Bhawan near City High School Road in Berhampur Death anniversary of former Odisha Chief Minister Biju Patnaik observed at Suchana Bhawan in Bhubaneswar

DC opt to field against GT in IPL

Ahmedabad: Delhi Capitals skipper Rishabh Pant won the toss and decided to field against Gujarat Titans in their IPL match here Wednesday. DC made one change, replacing David Warner with Sumit Kumar. GT, on the other hand, made three changes, bringing in Sandeep Warrier in place of veteran pacer Umesh Yadav. Wriddhiman Saha and David Miller were...