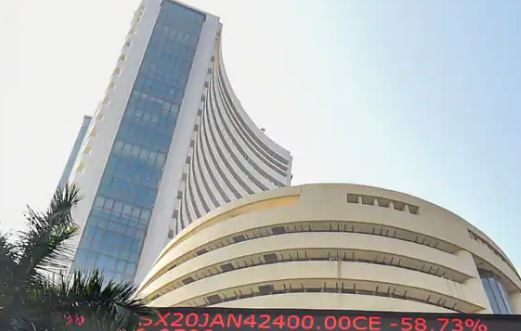

Mumbai: Benchmark equity indices Sensex and Nifty declined Wednesday, dragged down by banking and financial stocks amid weak trends in global markets.

Besides, weak earnings numbers and persistent foreign fund outflows impacted market sentiments, traders said

The BSE Sensex tumbled 426.85 points or 0.53 per cent to settle at 79,942.18.

The NSE Nifty dropped 126 points or 0.51 per cent to 24,340.85.

From the 30-share Sensex pack, Infosys, ICICI Bank, Kotak Mahindra Bank, Mahindra & Mahindra, State Bank of India, HCL Technologies, Axis Bank, NTPC and HDFC Bank were among the laggards.

In contrast, Maruti, IndusInd Bank, Adani Ports, ITC and UltraTech Cement defied broader market trends and ended in positive territory.

Foreign institutional investors (FIIs) were net sellers in the capital markets on Tuesday, as they offloaded shares worth Rs 548.69 crore, according to exchange data.

“In the near term, the market will be influenced by two factors – one positive and the other negative. The positive is the sharp decline in FII selling to just Rs 548 crore on Tuesday. This is an indication that the FII tactical trade of ‘Sell India, Buy China’ is coming to an end.

“With more Domestic Institutional Investors (DII) and retail money coming to the market and FII selling tapering off, the market may get a near-term boost, aided by the festive mood. But the uptrend is unlikely to sustain since the Q2 earnings numbers indicate softness in earnings for FY25,” VK Vijayakumar, Chief Investment Strategist, Geojit Financial Services, said.

In Asian markets, Seoul, Shanghai and Hong Kong settled lower, while Tokyo ended in the positive territory.

European markets were trading lower. The US markets ended on a mixed note on Tuesday.

Global oil benchmark Brent crude climbed 0.63 per cent to USD 71.57 a barrel.

The BSE benchmark climbed 363.99 points or 0.45 per cent to settle at 80,369.03 on Tuesday. The Nifty rose 127.70 points or 0.52 per cent to 24,466.85.

PTI