New Delhi: The US Fed interest rate decision and ongoing quarterly earnings from corporates are the major factors to drive the equity markets this week, where the benchmark indices may face volatile trends amid the scheduled monthly derivatives expiry, according to analysts.

Besides, trends in global markets and the trading activity of foreign investors would also influence domestic equities.

“July 26, the US Federal Reserve will announce its policy decision, and there is an expectation of a 25 basis point rate hike. Market participants will closely analyse the comments made during the announcement. Additionally, on July 28, the Bank of Japan will also reveal its policy decision,” Santosh Meena, Head of Research at Swastika Investmart Ltd, said.

Companies like Tata Steel, Asian Paints, Axis Bank, Bajaj Finance, BPCL and Tech Mahindra will release their earnings throughout the week, Meena added.

Shares of Reliance Industries Ltd, India’s most valuable company, will be in focus on Monday after the company on Friday reported an 11 per cent drop in its June quarter net profit on account of weakness in mainstay oil-to-chemical (O2C) business as well as higher finance and depreciation cost.

“The July F&O expiry on Thursday is likely to introduce some volatility into the market. Furthermore, market participants will keep a close eye on the ongoing monsoon session of Parliament. Institutional flows will be closely watched, as Foreign Institutional Investors (FIIs) have been significantly investing in Indian equity markets for the past three months,” Meena said.

The rupee movement against the US dollar and global oil benchmark Brent crude will also remain in focus this week.

“Investors will closely focus on the FOMC (Federal Open Market Committee) meeting. While a 25-basis point rate hike is widely expected, investors will be more interested in the committee’s commentary on future rate actions, seeking clues for the anticipated future rate pause,” Vinod Nair, Head of Research at Geojit Financial Services, said.

“Markets will take further cues from ongoing Q1 FY24 results, global market trends, crude oil prices and FII/DII (Domestic Institutional Investors) activities.

“Ongoing quarterly earnings season will be in focus, as many major companies will be announcing their quarterly numbers this week, such as Canara Bank, Tata Steel, Asian Paints, Bajaj Auto, L&T, Tata Motors, Axis Bank, BPCL, Tech Mahindra and Nestle,” Arvinder Singh Nanda, Senior Vice President of Master Capital Services Ltd, said.

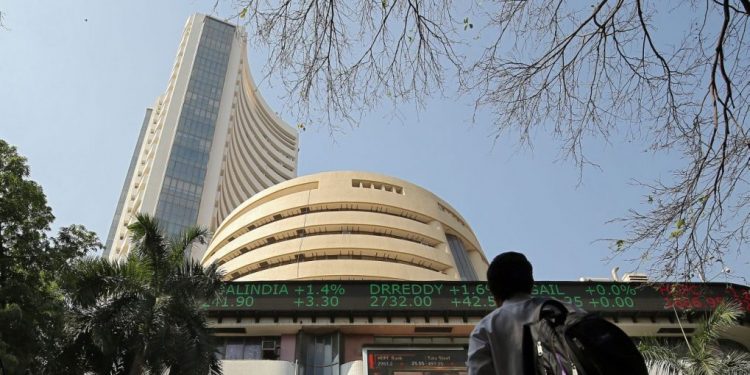

Last week, the 30-share BSE Sensex jumped 623.36 points or 0.94 per cent. The benchmark hit its all-time high of 67,619.17 July 20 (Thursday).

“We expect higher volatility this week due to the scheduled monthly expiry of July month derivatives contracts. However, the prevailing buoyancy on the global front, especially the US markets, would help in keeping the tone positive,” Ajit Mishra, SVP – Technical Research at Religare Broking Ltd, said.

A steady up move in the US markets combined with continued buying across sectors kept the tone positive for most of the last week, Mishra said, adding that a sharp cut in the IT majors trimmed the gains in the final session.

PTI