New Delhi: Equity investors grew richer by Rs 32.49 lakh crore in 2020 on the back of smart returns in the stock market which had a roller-coaster ride during the year hit by the coronavirus pandemic.

The COVID-19 outbreak ravaged lives and livelihoods on a global scale, shuttering businesses and jolting world equities.

But amid all the gloom, Indian stock indices gave hope of returning to winning ways towards the latter part of the year.

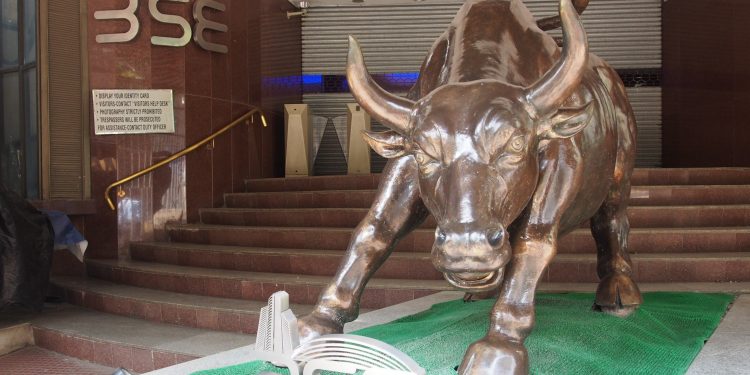

The Sensex gained 15.7 per cent in a memorable year 2020, where the BSE benchmark saw both ruthless selling and massive buying.

Markets witnessed volatile trends during the year, with the benchmark crashing to its one-year low of 25,638.9 on March 24, only to roar back to its record high of 47,896.97 on the last day of trade.

During the entire year, the 30-share BSE Sensex made monthly gains in seven, while closing with losses in five of them.

March proved to be dreadful for Dalal Street, with the Sensex plunging a massive 8,828.8 points or 23 per cent during the month as concerns related to the impact of the coronavirus pandemic on the economy jolted investor sentiments.

It was a volatile last day of trade for the market, with the BSE benchmark inching up 5.11 points to reach its new closing record of 47,751.33.

For the entire year, the market capitalisation of BSE-listed firms zoomed by Rs 32,49,689.56 crore to reach Rs 1,88,03,518.60 crore.

“The effect of the crash in March was completely undone over a few months that followed, and markets rose much more to touch peak levels.

“While expectations of a rebound in economic growth, and the consequent resurgence in corporate earnings, breathe into the markets an unusual optimism, the fact that India would continue to be one of the fastest growing economies in the world with a large consumer market, and an extraordinary potential for growth and development, instils greater confidence in not only domestic investors but also overseas investors,” said Joseph Thomas, Head of Research, Emkay Wealth Management.

“This is the singular factor that would keep the markets going, but we need to be cautious about the pandemic, keep a watch on its effective containment in crucial geographies like the US and EU, and also build in the implications of rising inflation and higher oil prices into our expectations on interest rates,” he added.

A number of main board initial public offerings during the year, with many of them receiving massive subscription, including Burger King India and Mrs Bectors Food Specialities, added to the market optimism.

“2020 has turned out to be one of the most unpredictable years for everyone. Equity markets worldwide have gone through a roller-coaster ride in this calendar year.

“The Nifty-50 fell 40 per cent between January and March and then rose by 86 per cent from the lows of March. Unprecedented fiscal and monetary support from governments and central banks has led to massive liquidity infusion into global markets. India is one of the few emerging markets to receive strong FPI flows,” said Rusmik Oza, Executive Vice President, Head of Fundamental Research at Kotak Securities.

Reliance Industries Limited remained the country’s most valuable firm with a market valuation of Rs 12,58,157.10 crore, followed by TCS (Rs 10,77,009.46 crore), HDFC Bank (Rs 7,91,312.61 crore), Hindustan Unilever Limited (Rs 5,62,378.04 crore) and Infosys (Rs 5,34,940.34 crore) in the top five.

“As we enter 2021, markets are sitting at all-time highs and are showing resilience on the back of abundant liquidity, positive developments on the vaccine front and signs of economic recovery,” said Hemang Jani, Head Equity Strategist at Motilal Oswal Financial Services (Broking & Distribution).

Vinod Nair, Head of Research at Geojit Financial Services said, “Despite the havoc created by the COVID-19 pandemic, the economy is expected to recover in 2021 giving a boost to the equity markets in addition to upgrades in corporate earnings.”

PTI