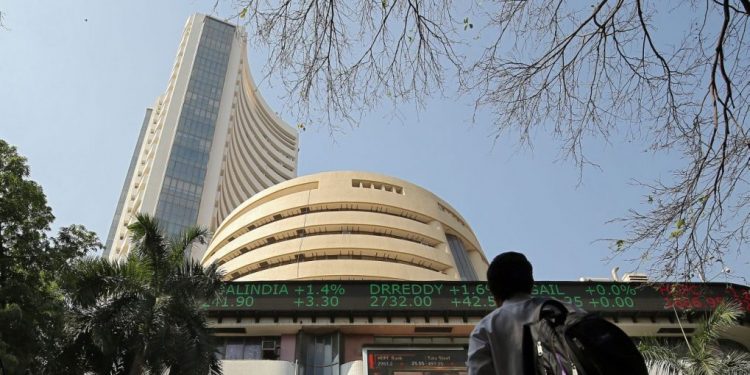

Mumbai: Benchmark BSE Sensex rose by 123 points while Nifty closed above the 18,600 level in their fourth straight day of gains Tuesday helped by FII inflows and firm Asian markets.

Gains in financial, banking, capital goods and industrial shares helped the key indices close in the green in a range bound trade. Selling in select metal, IT and oil and gas shares restricted gains in key indices.

The 30-share BSE Sensex climbed 122.75 points or 0.20 per cent to settle at 62,969.13. During the day, it jumped 189.74 points or 0.30 per cent to 63,036.12. The broader NSE Nifty advanced 35.20 points or 0.19 per cent to end at 18,633.85.

Stock markets have been on the rise since Thursday last week. Sensex advanced by 1,195 points or 2 per cent while Nifty rose by 348 points or 2.26 per cent in the four-day rally.

“The domestic market continued its rally as recent Q4 results indicated improvement in demand. Further, expectations of a normal monsoon and a drop in international commodity prices supported the rise in the margin profile,” said Vinod Nair, Head of Research at Geojit Financial Services.

Hotels to cigarette conglomerate ITC was the biggest Sensex gainer, rising by 2.31 per cent..

Bajaj Finserv, Kotak Mahindra Bank, Bajaj Finance, Axis Bank, HCL Technologies, Wipro, UltraTech Cement, Maruti and Infosys were among the major gainers.

On the other hand, Tech Mahindra fell the most by 1.27 per cent among Sensex shares. Tata Steel, Nestle, Larsen & Toubro, TCS, Tata Motors and Titan were among the laggards.

In the broader market, the BSE smallcap gauge climbed 0.22 per cent and midcap index advanced 0.16 per cent.

Among the indices, financial services, services, teck, capital goods, bankex, IT and industrials were the gainers.

Commodities, energy, telecommunication, auto, consumer durables, metal, oil & gas and realty were the laggards.

“Markets managed to end higher in a range bound session, in continuation to the prevailing trend. After the flat start, it oscillated in a narrow range and settled around the upper band to close at 18,633.85 levels. Markets are gradually inching towards the record high however mixed global cues are capping the momentum,” said Ajit Mishra, SVP – Technical Research, Religare Broking Ltd.

Meanwhile, the Reserve Bank in its annual report said that India’s growth momentum is likely to continue in 2023-24 even as it made a case for pushing structural reforms to deal with the geopolitical developments and also to achieve sustained growth in the medium-term.

In Asian markets, Seoul, Tokyo, Shanghai and Hong Kong ended in the green. The US markets were closed on Monday for Memorial Day. Foreign Institutional Investors (FIIs) were net buyers on Monday as they bought equities worth Rs 1,758.16 crore, according to exchange data.

“As markets shrugged away inflation, supply-chain disruptions and a slowdown in certain discretionary spends, buoyant FII inflows of Rs 450 billion since April have powered the Bank Nifty to its yearly-high on Tuesday ahead of the MSCI rejig on Wednesday.

“The sight of 63K on the BSE SENSEX today was indeed music to Bulls who made Hay in May,” S Ranganathan, Head of Research at LKP Securities said.

Meanwhile, global oil benchmark Brent crude declined 2.30 per cent to $75.30 a barrel.

The BSE benchmark climbed 344.69 points or 0.55 per cent to settle at 62,846.38 Monday. The Nifty gained 99.30 points or 0.54 per cent to end at 18,598.65.

PTI