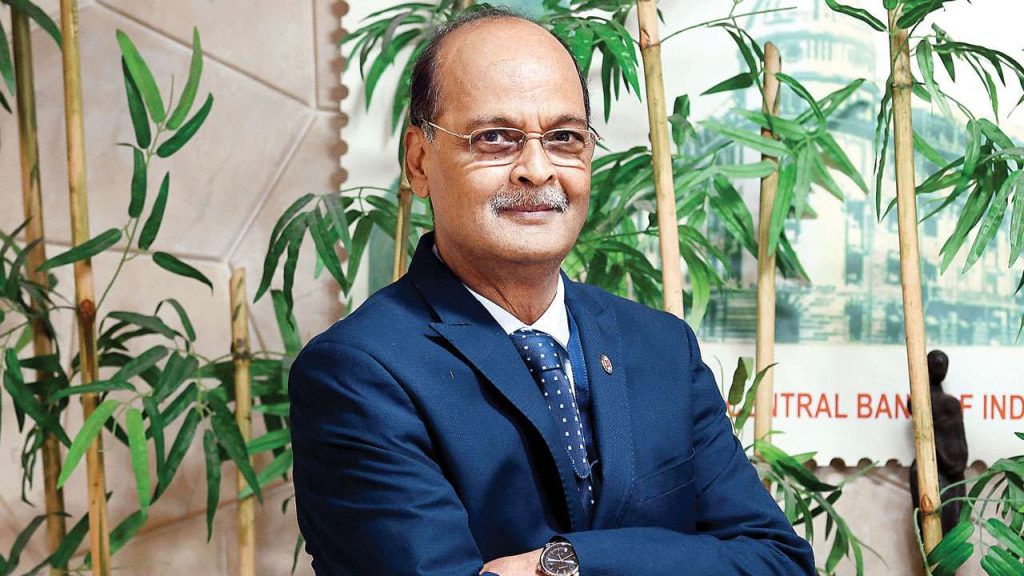

Central Bank of India has been reporting losses for the past 12 quarters since December 2015. Pallav Mohapatra was appointed Managing Director and Chief Executive Officer of the bank September 2018 in the middle of such a difficult situation for the bank. He spoke with Dipchand Bihari of Orissa POST about the business strategies he has directed to pull the bank out of its NPA crisis. Excerpts:

# What have been your major priorities since assuming charge?

My first priority has been to bring the bank out of the Prompt Corrective Action (PCA) framework and we are working on it. I hope the bank will exit PCA by the end of this financial year. Also, I am focusing on business growth, recovery of debt, maintaining the quality of assets and improvement in operation areas. We also plan to focus on agriculture and MSMEs. We are aiming at growth in retail, agriculture and MSME loans from 16 per cent to over 17 per cent of total advances this fiscal.

# How are you managing the NPA crisis at the bank?

We plan to recover bad loans to the farthest possible extent to overcome losses. We are working to prevent further slippages and to get more quality loans on board to emerge from the losses. We are also digitising operations to cut costs of operation.

# What caused such huge losses to the bank in the first place, and what is being done to recover bad loans?

The bank had sanctioned a large number of corporate loans and many of these accounts have become non-performing assets owing to various reasons. We have a department that focuses on recovery. We are doing cash recovery and also restructuring loans to recover bad loans. We have sought help from the NCLT for recovery.

# But the NCLT is taking time to process claims . . .

The NCLT’s IBC process started only in 2016. It is also evolving and has stabilised to a large extent. It will take some more time to fully stabilise.

# What makes you confident about a turnaround by end of this fiscal?

The fourth quarter results of the bank have brought directional changes and we hope to go forward this fiscal. The changes we are bringing in the bank will help a turnaround. We are getting good results in recoveries. The NPA percentage came down from 11 per cent to 7 per cent. We hope it will fall to below 6 per cent, which is the threshold for PCA. We are going to the market to raise the capital. My leverage issue will also improve.

# What is the status of your exposure to IL&FS?

We have exposure of about Rs 1,400 crore. But now IL&FS has been taken over by the board appointed by government of India, so, they are working out the resolution of a lot of group companies. Hopefully, in this financial year, we will be able to see some results from the resolution process.

# Does the bank have plans to sell some bad loans to Asset Reconstruction Companies to bring down NPA?

Yes. It is one process in resolving NPAs and is done in accordance with regulatory norms. These entities are specialised to look at restructuring and asset restructuring is an effecting way of resolution resolving NPAs.