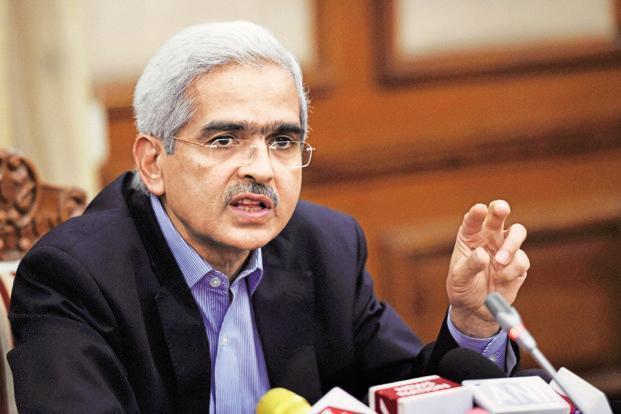

New Delhi: The recovery of the Indian economy reeling from the impact of the Covid-19 pandemic will be gradual, RBI Governor Shaktikanta Das said Wednesday.

Addressing the FICCI National Executive Committee Meeting, the central bank chief said that the country is still reeling under the impact of Covid-19 and will gradually come back on normal growth path.

He, however, said that things have considerably improved in the second quarter after adverse impact the pandemic had on economic activity in the first quarter.

“Nevertheless, high frequency indicators of agricultural activity, the purchasing managing index (PMI) for manufacturing and private estimates for unemployment point to some stabilisation of economic activity in Q2, while contractions in several sectors are also easing,” he said.

“The recovery is, however, not yet fully entrenched and moreover, in some sectors, upticks in June and July appear to be levelling off. By all indications, the recovery is likely to be gradual as efforts towards reopening of the economy are confronted with rising infections.”

According to Das, financial market conditions in India have eased significantly across segments in response to the frontloaded cuts in the policy repo rate and large system-wide as well as targeted infusion of liquidity by the RBI.

“Despite substantial increase in the borrowing programme of the government, persistently large surplus liquidity conditions have ensured non-disruptive mobilisation of resources at the lowest borrowing costs in a decade,” he elaborated.

In August 2020, the yield on 10-year G-sec benchmark surged by 35 basis points amidst concerns over inflation and further increase in supply of government papers.

Following the RBI’s announcement of special open market operations (OMOs) and other measures to restore orderly functioning of the G-sec market, bond yields have softened and traded in a narrow range in September.

“Although bank credit growth remains muted, scheduled commercial baks’ investments in commercial paper, bonds, debentures and shares of corporate bodies in this year so far (up to August 28) increased by Rs 5,615 crore as against a decline of Rs 32,245 crore during the same period of last year,” he said.

“Moreover, the benign financing conditions and the substantial narrowing of spreads have spurred a record issuance of corporate bonds of close to Rs 3.2 lakh crore during 2020-21 up to August.”

Besides, he pointed out that the immediate policy response to Covid in India has been to prioritise stabilisation of the economy and support a quick recovery.

Citing World Bank assessment, Das said that recovery globally would take a longer route as it is not fully entrenched.

(IANS)