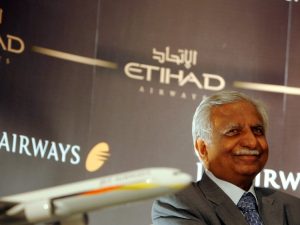

New Delhi: Jet Airways promoter Naresh Goyal and his wife Monday announced their decision to step down from the board of the airline he had founded 25 years ago under pressure from lenders who are being seen as rescuers of an asset that nearly went bust but for the government’s intervention.

Experts say the government, through its bankers, undertook a “backdoor nationalisation” of Jet Airways Ltd.

The roadmap is troubled as the resolution plan led by the State Bank of India (SBI) is that the lenders will install a board for day-to-day operations and revive the airline, give comfort level to the pilots by paying their salaries and rentals to the lessors and bring it to the stage of selling to a new owner to recover their loans.

All this to be done under government-initiated intervention or through backdoor nationalisation of a private airline, said aviation experts.

With the Jet promoter and his wife stepping down from the board, the stage is set for giving the lenders the majority stake by converting part of its debt to equity as the beleaguered airline battles a cash crunch, the lenders, most of whom are government-owned, are now the owners of the airline. And all this has been done at Re 1.

Jet Airways, an airlines existing for over a quarter of a century but now grappling with a financial crunch, is also looking to raise fresh funds. Banking industry sources said that the government is only doing this to protect the banks’ money in the airlines and, in a poll year, the nearly 23,000 jobs that could be endangered.

There have been questions if this this is a bailout or backdoor nationalisation. After all, government-owned entities – banks like the SBI and DFIs – are prima facie the new owners of the airline. In a move reminiscent of Kingfisher Airlines, which subsequently went belly up in 2014, lenders, including the SBI, had converted existing debt into the loss-making company’s shares in 2011.

The Jet board, as part of a provisional resolution plan, agreed to allot 11.4 crore shares at an aggregate value of Re 1 to the lenders’ consortium led by the SBI, according to an earlier stock exchange filing of the airlines.

Through the conversion, the board of Jet Airways Ltd has approved an action plan by its lenders to resolve a near Rs 8,500 crore ($1.19 billion) funding gap, which will make them the largest shareholders of India’s biggest full-service carrier.

Do the lenders have the wherewithal and expertise to run a full-face airline with so many imponderables strewn in its path? Or will they try and stabilise the operations only to sell it or merge it later with another domestic carrier? For the moment, the government is saddled with two debt-laden carriers – Air India and now Jet Airways.

Through the conversion, the lenders will end up owning 50.1 per cent in the full-service carrier. That will bring down Goyal and Etihad Airways’ stake by half to 25 per cent and 12 per cent, respectively, according to back-of-the-envelope calculations.

The banks, led by the SBI, will now convert their debt into equity and take a controlling stake in the airline for a token sum of 1 rupee ($0.0145), Jet said in a statement to the stock exchanges after its board met earlier Monday.

The banks will also give the airline a fresh loan of Rs 1,500 crore ($217.71 million) to meet payments and restore normal operations and set up an interim management committee to manage the airline, Jet said.

Jet, saddled with over $1 billion in debt, had a turbulent 2018 as competition intensified in the Indian airline market, the rupee depreciated and high oil prices squeezed margins. The rescue deal by Jet’s lenders, led by the SBI, includes funding through a mix of equity infusion, debt restructuring and sale or leaseback of aircraft.

The plan also gives the lenders the ability to appoint nominees to the airline’s board.

Jet said that after its approval, the plan will be presented back to the lenders as well as to an overseeing committee of the Indian Bankers’ Association, the board of shareholder Etihad Airways and Goyal.

Abu Dhabi’s Etihad, which owns 24 per cent of Jet, bailed out the Indian airline in 2013, paying $600 million for a 24 per cent stake in Jet, three take-offs and landing slots at London’s Heathrow and a majority share in Jet’s frequent flyer programme.

IANS