Mumbai: The Reserve Bank for the second time in two months Wednesday raised its benchmark interest rate by 25 basis points on inflationary concerns, a move that will make home, auto and other loans expensive.

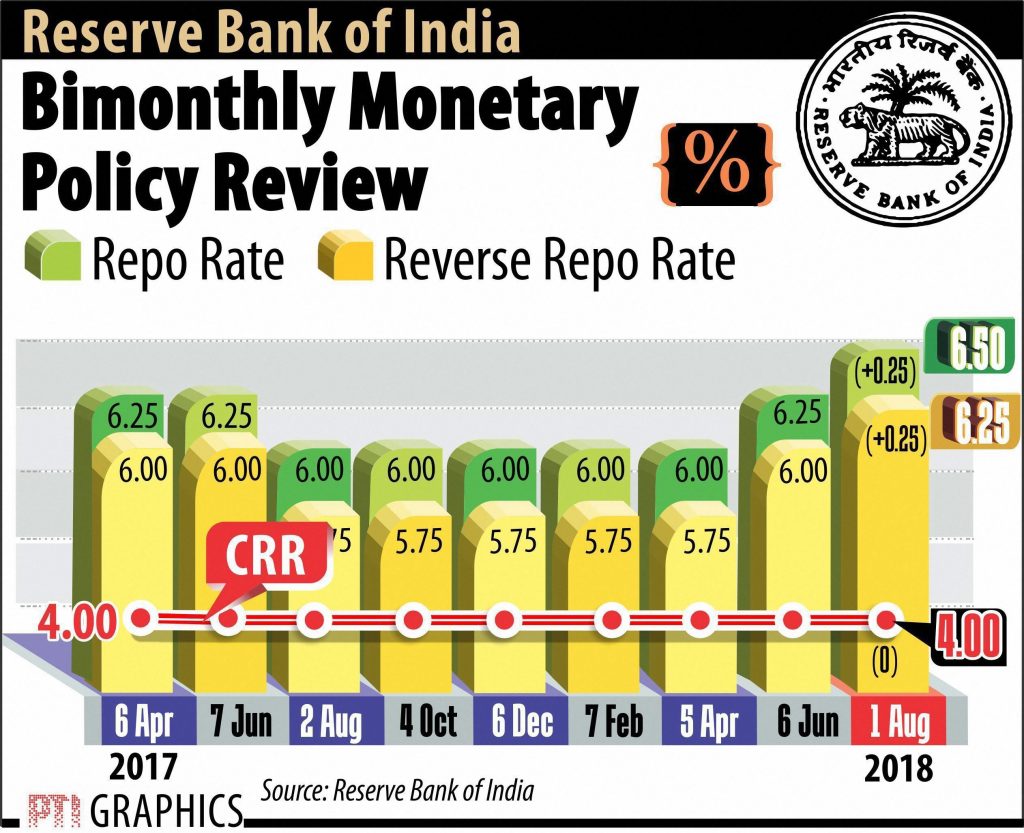

With five of its members voting for the increase, the 6-member Monetary Policy Committee (MPC) headed by RBI Governor Urjit Patel, increased repo rate, at which it lends to other banks, to 6.5 per cent but kept its policy stance as “neutral”.

The reverse repo rate, at which it borrows from banks, was also raised by similar proportion to 6.25 per cent. The marginal standing facility (MSF) rate and the bank rate were also raised to 6.75 per cent.

Following the rate hike, the BSE Sensex slipped from record high to end 84.96 points lower at 37,521.62.

Anticipating firming of interest rate, country’s largest lender SBI has raised fixed deposit rate by up to 0.1 per cent. Other banks are also likely to firm up lending rates making loans costlier for borrowers. RBI had last raised the repo rate June 6 by 0.25 per cent to 6.25 per cent. That increase was the first since January 28, 2014 when rates were hiked by a similar proportion to 8 per cent.

RELATED REPORT: Rate hike reflects uptick in credit demand: Industry

In the subsequent years, RBI cut interest rate on six occasions. In its last revision, August 2, 2017, rates were cut by 25 basis points to 6 per cent.

In the third bi-monthly monetary policy of the 2018-19, RBI Wednesday cited various concerns to inflation like volatile crude prices, uncertainty in the global financial market, hardening of input prices for corporates, uneven distribution of rainfall, fiscal slippages and rise in MSP of foodgrains. With regard to inflation, RBI said, it is projected at 4.6 per cent in second quarter, and 4.8 per cent in the second half of 2018-19.

More on the cards

Mumbai: With the Reserve Bank of India (RBI) raising the repo rate by a quarter percentage point to 6.5%, the second such hike in two months, money will become more expensive in the world’s fastest growing major economy. Two successive rate hikes indicate the beginning of a rate-hiking cycle even though there is no certainty on when the central bank will go for its next rate hike. Analysts said, going by the RBI’s hawkish stance on inflation, the central bank seems to have frontloaded the rate hike to dampen inflationary expectations. The rise in the minimum support price of foodgrains will also play its part in keeping the inflationary trend on the higher side.