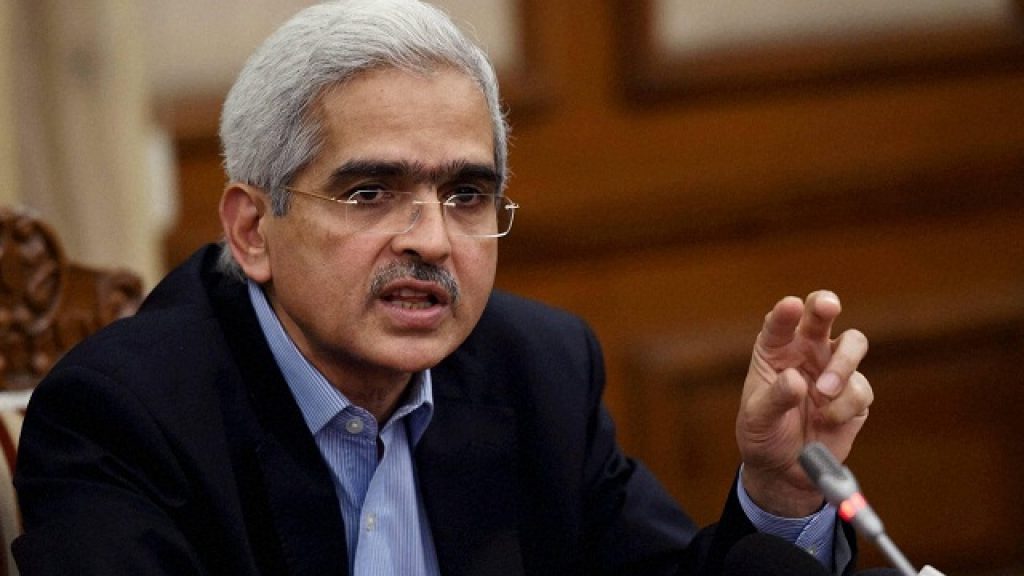

New Delhi: The Reserve Bank of India (RBI) left the repo rate at four per cent without change after the meeting of its six-member Monetary Policy Committee (MPC) that concluded Thursday morning. Addressing a presser, RBI governor Shakti Kanta Das also revealed the reverse repo rate to be unchanged at 3.3%

“The renewed surge of Covid-19 infection in major economies in July has subdued early signs of revival that had appeared in May and June,” Das said.

All major sectoral indexes, except automobiles, were trading higher ahead of RBI Governor Shaktikanta Das’s policy address.

There was both speculation and expectation that the RBI will slash the repo rate. The repo rate is the rate at which it lends funds to the banks. This was the 24th meeting of the MPC.

The rapidly changing macroeconomic environment and the deteriorating growth outlook necessitated RBI’S off-cycle MPC meetings was prompted by the rapidly changing macroeconomic environment and a fast falling growth outlook. The first MPC meeting was in March and then again in May 2020.

The MPC has cumulatively cut the repo rate by 115 basis points over these two meetings, resulting in total policy rate reduction of 250 basis points since February 2019, with an aim to boost economic growth.

The central bank has been taking steps proactively to lessen the impact of the bleak macroeconomic outlook to the economy caused by the pandemic and subsequent lockdowns.

PNN/Agencies