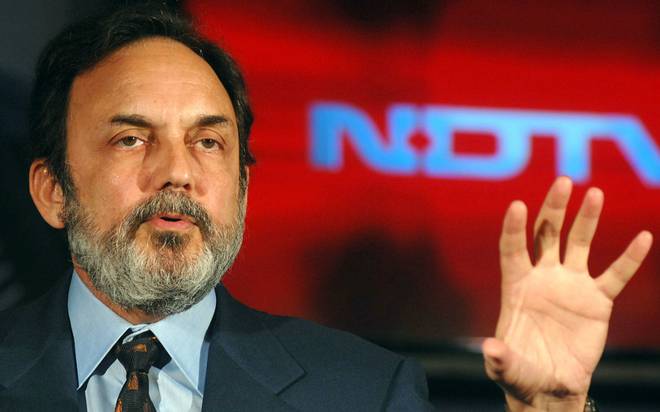

New Delhi: Regulator Securities and Exchange Board of India (Sebi) barred Friday, ‘NDTV Ltd’s’ three key promoters – Prannoy Roy, Radhika Roy and their holding firm – from the capital markets for two years and also restrained the two individuals from holding any board or top management role at the company in this period.

The Roy couple has also been barred from holding a board or key managerial position at any other listed company for one year, Sebi said while coming down heavily on them and RRPR Holdings Pvt Ltd for what it termed as violation of various regulations by keeping minority shareholders in the dark about three loan agreements.

One such loan agreement was with ICICI Bank while two loans were from a little-known entity Vishvapradhan Commercial Private Ltd (VCPL).

The ownership of Delhi-based ‘wholesale trading’ firm VCPL, incorporated in 2008, is said to have later changed hands from RIL to the Nahata Group, from which the Mukesh Ambani-led firm had bought Infotel Broadband in 2010 to re-enter the telecom business.

In its latest 51-page order, Sebi said all its directions, including debarment of RRPR, Prannoy Roy and Radhika Roy from buying, selling or otherwise dealing directly or indirectly in securities, or being associated with the securities market, will come into effect immediately. Their existing holdings, including mutual fund units, will remain frozen during the prohibition period, Sebi stated.

Sebi said its probe began after receipt of complaints in 2017 from Quantum Securities Pvt Ltd, a shareholder of NDTV, about alleged violation of rules by non-disclosure of material information to the shareholders about loan agreements with VCPL.

The ICICI Bank loan had a clause wherein the three promoters of NDTV had undertaken not to permit any major corporate restructuring, merger etc. without prior written approval of the lender.

Investigations found that another loan agreement was signed with VCPL for a loan of Rs 350 crore later, which did not carry any interest rate, to repay the ICICI Bank loan that had an interest rate of 19 per cent.

A second loan agreement for Rs 53.85 crore was also signed with VCPL a year later that provided for the promoters of NDTV allowing the lender to indirectly acquire 30 per cent stake in the media company through conversion of their warrants into equity shares of RRPR Holdings.

It was alleged that by concealing such material information from the public shareholders for a period when the promoters were themselves dealing in the company shares, they had committed a fraud on the minority public shareholders.

PTI