New Delhi: The Income Tax department Sunday said taxpayers can now access the new Annual Information Statement (AIS), which includes additional categories of information like interest, dividends, securities and MF transactions, and remittances from abroad, on the e-filing portal.

The I-T department had last month expanded the list of high-value financial transactions, which would be available to taxpayers in their Form 26AS by including details of mutual fund (MF) purchases, foreign remittances, as well as information in ITRs of other taxpayers.

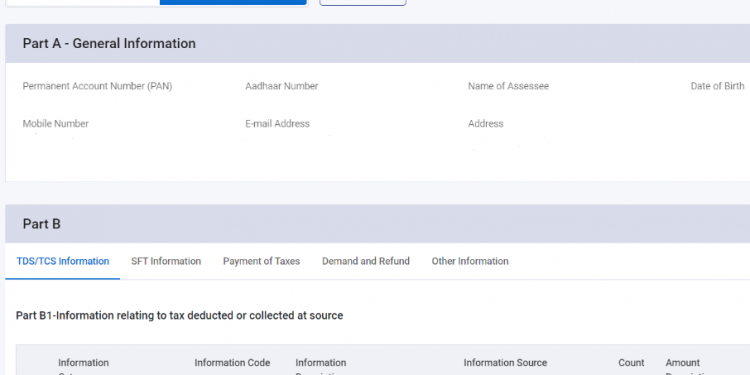

Form 26AS is an annual consolidated tax statement that can be accessed from the income-tax website by taxpayers using their Permanent Account Number (PAN).

“AIS provides ease of access! It can be accessed now on the e-filing portal & downloaded easily in downloadable formats of PDF, CSV & JSON (machine-readable format). Click on link ‘AIS’ under ‘Services’ tab on http://incometax.Gov.In,” the I-T department tweeted.

AIS enables a taxpayer to see and verify taxpayer info available with taxmen, provide feedback in case of discrepancies, view/update the Taxpayer Information Summary (TIS) used for pre-filling of ITR.

The Budget for 2020-21 had announced the revised Form 26AS, giving a more comprehensive profile of the taxpayer, going beyond just the details of tax collected and deducted at source.

Additional information prescribed includes foreign remittance made by any person through an authorised dealer, the breakup of the salary with deductions claimed by the employee, information in ITR of other taxpayers, interest on income tax refund, information published in the statement of financial transactions.

Also, off-market transactions reported by depository/ registrar and transfer agent, information about dividend of mutual fund reported by RTA, and information about the purchase of mutual fund reported by RTA too would be included in Form 26AS.

The Budget 2020-21 had introduced a new Section 285BB in the Income Tax Act, to revamp Form 26AS to an ‘Annual Information Statement’ which apart from the TDS/ TCS details, would contain comprehensive information relating to specified financial transactions, payment of taxes, demand/ refund and pending/completed proceedings undertaken by a taxpayer in a particular financial year that has to be mentioned in the income tax returns.

Following that, in May last year, the I-T department had notified the revised Form 26AS, including information on high-value financial transactions undertaken during a financial year, a move which also facilitated voluntary compliance and ease of e-filing of I-T returns.

With this last month’s I-T department order, the list of details to be available in Form 26AS has been expanded further.

AMRG & Associates Director (Corporate & International Tax) Om Rajpurohit said even though the AIS facility provides extensive information on salaries, stocks, mutual funds, dividends, interest, and other financial items but presently it does not include information on income from futures and options.

“In addition, there are anomalies reflecting in capital gain computations that must be remedied prima facie.

“Thus, for the time being, the question of how helpful/complex it is for a layman remains unresolved and will be addressed in the near future, since it requires a comprehensive analysis and reconciliation of information in cases when a person has numerous sources of income,” Rajpurohit added.

PTI