New Delhi: India’s growth is set to further accelerate on the back of the path-breaking plan to set up a ‘Bad Bank’, which is expected to absorb Rs 2 lakh crore worth of non-performing assets (NPA).

Accordingly, the process is expected to clean up banks’ books and allow them to lend more freely.

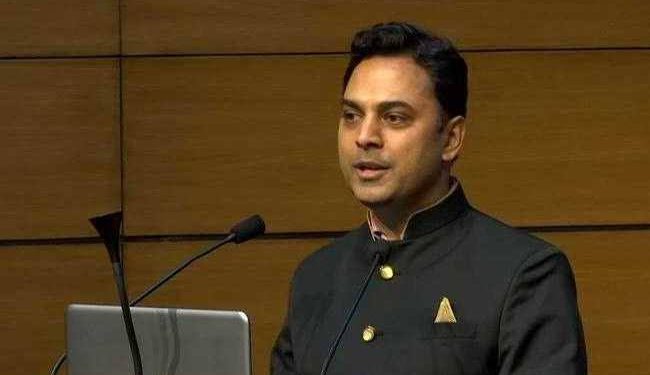

According to the Finance Ministry’s Chief Economic Advisor Krishnamurthy Venkata Subramanian, the crucial reform measure in the sector will pave the way for a stronger banking sector.

In a conversation with IANS, he said the Budget proposal on ‘Bad Bank’ is really critical for the sound health of the financial sector as it would clean up the balance sheets of banks while also giving them opportunity to raise additional capital from the market to step up lending.

“…in excess of Rs 2 lakh crore of bad assets are actually likely to be transferred to the bad bank,” he told IANS.

The CEA said that with banks provisioning for bad assets rising to 85 per cent against 15 per cent for bad assets, a lot of hit that banks would have otherwise taken in these toxic assets have already been covered.

With ‘Bad Bank’ coming into the picture, banks would not only get higher realisation for bad assets but also free up their capital that could also help in augmenting capital by tapping market with share offering.

According to the RBI’s bi-annual financial stability report (FSR), bank NPAs may rise to as high as 14.8 per cent in one year in case of a severe stress scenario, from 7.5 per cent as of September 2020 or close to Rs 7.5-8 lakh crore. The RBI’s stress test covers the first six months of the current fiscal ended March and projects a baseline scenario of gross NPAs (GNPAs) at 13.5 per cent.

So, even if the bad bank picks up an Rs 2 lakh crore tab, the stress in the banking sector would be relieved by a significant margin.

On Monday, Finance Minister Nirmala Sitharaman proposed creation of an Asset Reconstruction Company and Asset Management Company to consolidate and take over the existing stressed debt and then manage and dispose of the assets to Alternate Investment Funds and other potential investors for eventual value realisation.

The proposal was made by Sitharaman in the Union Budget FY22.

A ‘Bad Bank’ buys non-performing loans of scheduled lenders at the current market price. It is considered vital to a robust banking ecosystem.

IANS