New Delhi: The rate hike by RBI reflects an uptick in credit demand, the industry said Wednesday, even as it urged the central bank not to take growth for granted.

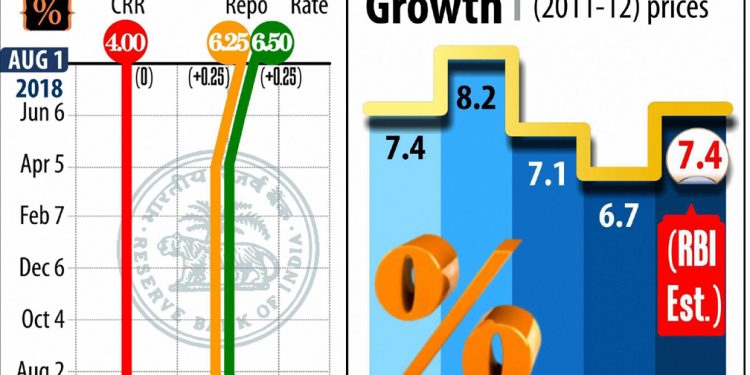

The Reserve Bank’s Monetary Policy Committee raised the benchmark interest rate by 25 basis points for the second time in two months on inflationary concerns.

The repo rate, at which the central bank lends to other banks, now stands at 6.50 per cent.

“What needs to be ensured is that the private sector should not be crowded out for raising resources from the market,” Assocham President Sandeep Jajodia said.

Mahindra Mutual Fund MD and CEO Ashutosh Bishnoi said the RBI’s action reflects an uptick in credit demand and the underlying economic growth that is driving it.

“With the rate cycle on the upswing, investment opportunities are coming up in the form of new debt funds.

“In this rate regime, any new investments made in the debt markets are likely to perform well over the next couple of years,” Bishnoi said.

Jajodia observed that the Monetary Policy Committee (MPC) should not take growth for granted, especially when the twin balance sheet problem still persists and a large part of corporate India continues to reel under heavy debt.

The six-member MPC, headed by RBI Governor Urjit Patel, kept its stance as ‘neutral’.

For July-September, it pegged CPI-based retail inflation at 4.2 per cent which it saw firming up to 4.8 per cent in the second half of the current fiscal.

The projected inflation rate is above its targeted comfort level of 4 per cent.

The RBI kept the GDP forecast for the current fiscal unchanged at 7.4 per cent and saw it at 7.5-7.6 per cent in the second half of the current fiscal.

REALTORS UNHAPPY: Housing sales are likely to be affected post RBI’s decision to hike key policy rates as this could lead to increase in interest rate on home loans, according to property developers and consultants.

The Reserve Bank for the second time in two months has raised its benchmark interest rate by 25 basis points on inflationary concerns.

“From a real estate perspective, this hike will negatively impact buyer sentiment with the logical result on quantum of sales,” realtors’ body NAREDCO President Niranjan Hiranandani said.

Realtors’ body CREDAI National President Jaxay Shah said: “Two consecutive hikes in the repo rate partially undo the policies for promoting affordable housing. We urge the government to expedite lowering effective GST on all housing to 8 per cent so as to preserve the growth impulses in real estate.”

Realty major DLF’s CEO Rajeev Talwar said: “This second consecutive repo hike will push overall interest rates in the economy, which may impact the real estate and consumer goods sector that has just started seeing green shoots.”

The hike might be a “temporary dampener” especially in the affordability housing sector as the borrowing cost for the sector will go up, he added.

EXPORTERS TOO: The Federation of Indian Export Organisation, Southern region, Wednesday said the RBI’s repo rate hike was on expected lines given the inflation outlook while Knitwear exporters in Tirupur expressed concern that the increase in cost of credit would impact the sector.

The FIEO’s southern region Chairman A Sakthivel, however, pointed out the tight liquidity conditions faced by the export sector especially, by the MSME, and requested the RBI Governor to bring export credit under priority lending category immediately.

“The unfavourable condition in our major markets, tough competition from neighbouring countries coupled with higher interest cost and deficiency in dispensation of working capital requirement of the exporters strongly argue for the need for placing Export Finance under priority sector lending,” he said in a release.

Tirupur Exporters’ Association President Raja Shanmugham said the increase in cost of credit would make the export units “un-competitive” and would impact the knitwear garment exports.

In a statement, he said the sector was already struggling due to the price pressure in overseas market.

RBI COMMITMENT SHOWS: Bankers Wednesday said the Reserve Bank of India’s decision to hike repo rate by 25 basis points shows the apex bank’s commitment to bring retail inflation to 4 per cent.

Lenders believe that the neutral stance adopted by the RBI shows it’s willingness to be accommodative with uncertainty over global growth.

“The decision to keep the stance in neutral mode indicates RBI’s willingness to be flexible and accommodative with global growth continuing to be uncertain,” said Rajnish Kumar, chairman, State Bank of India.

After increasing the repo rate by 25 bps in its June policy review, the RBI today again hiked the key policy rate by 25 basis points to 6.5 per cent.

Its decision to raise repo rate by 25 bps for the second time in succession is a clear desire to frontload the rate hike cycle, said Kumar.

Standard Chartered Bank chief executive officer (India) Zarin Daruwala said, “The 25 basis points hike reaffirms RBI’s commitment to bringing CPI inflation to 4 per cent on a durable basis. The bond market sentiment was boosted by a balanced policy guidance and retention of the ‘neutral’ stance.”

HDFC’s chief economist, Abheek Barua, said, today’s policy decision suggests that the RBI seems to be taking a long term view on inflation rather than remaining purely data dependent.

“Given the upside risks to inflation, discussed extensively, another policy rate hike cannot be ruled out,” he said.

Barua, however, said if there is an escalation in trade war risks and a resultant global output compression, then the RBI could be prompted to stay on a prolonged pause.

Indian Banks Association’s chairman (officiating), Shyam Srinivasan, said though there are several risk factors to growth which could tilt on either side, the RBI has not only maintained the growth projection of 7.4 per cent for this fiscal, but also projected a higher rate of 7.5 per cent for the first quarter of next year as well.

“This could cheer the markets,” he noted.

Yes Bank’s managing director and chief executive officer, Rana Kapoor, said, “With peak of CPI inflation now behind us, and monetary transmission playing out gradually hereon, I expect a pause in the remainder of FY19.”

Bandhan Bank managing director and chief executive officer Chandra Shekhar Ghosh said with the uncertainties on the external front and the pressure on inflation, the RBI has taken the right decision.

“The impact of the rate hike will be seen with a lag effect, giving the RBI time to decide on the next course of action,” he added.

IBA’s Srinivasan said co-origination of loans by banks and NBFCs could possibly open a new chapter on innovative lending and bringing together the expertise of both the parties.

“All these reforms could help in strengthening the financial sector,” he added.

Rating agency Crisil believes the RBI will be on hold hereon unless higher-than-anticipated upside risks to inflation from crude oil, stronger demand conditions and food prices materialise.

India Ratings and Research’s principal economist, Sunil Kumar Sinha, said by keeping monetary policy stance neutral, the apex bank has kept the window open to move the policy rate in future in either direction subject to data.

“With this rate hike, it is unlikely that there would any more hike in FY19,” he noted.