Mumbai: The Reserve Bank of India (RBI) Friday expectedly kept interest rates unchanged at a record low as it chose to support economic revival despite raising its forecast for inflation.

The six-member Monetary Policy Committee (MPC) voted unanimously to retain the main repurchase (repo) rate — the key lending rate at which the central bank lends short-term funds to banks — at 4 per cent, but was split on continuing with the lower-for-longer stance.

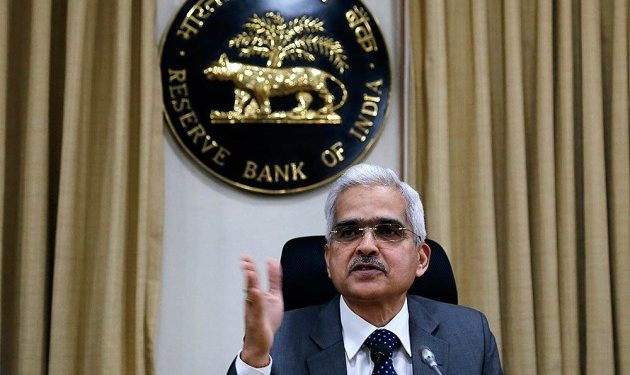

“The MPC also decided on a 5 to 1 majority to continue with the accommodative stance as long as necessary to revive and sustain growth on a durable basis,” RBI Governor Shaktikanta Das said while announcing the monetary policy.

This was a departure from the past when they were unanimous on the need to support growth.

An accommodative stance means a rate hike is unlikely.

This is the seventh time in a row that RBI has left the policy rate unchanged. RBI had last revised its policy rate on May 22, 2020 in an off-policy cycle to perk up demand by cutting the interest rate to a historic low amid the onset of the Covid-19 pandemic.

Prior to that, the MPC had cut key lending rates by 250 basis points since February 2019 to support growth.

With the ebbing of the second Covid wave, RBI retained its GDP growth forecast for the current fiscal year ending in March 2022 at 9.5 per cent, but revised its retail inflation forecast to 5.7 per cent, up from the earlier 5.1 per cent.

The projected inflation being closer to the upper tolerance band implies price pressures are not likely to ease anytime soon despite the revival of monsoon and pick up in Kharif sowing.

RBI saw consumer price inflation (CPI) peaking to 5.9 per cent in July-September before falling to 5.3 per cent in the next quarter and rising to 5.8 per cent in January-March. Consumer inflation is seen at 5.1 per cent in first quarter of the next fiscal FY23.

The central bank scaled down the growth projections for the next few quarters in the current fiscal but raised the forecast for April-June to 21.4 per cent.

This, analysts said, may be reflective of its concerns on the pace of consumption demand revival despite the expectations of a favourable Kharif crop, buoyant exports, steady progress in vaccination, and a conducive monetary and fiscal policy.

Growth in Q1 of next fiscal was forecast at 17.2 per cent.

“The supply-side drivers could be transitory while demand-pull pressures remain inert, given the slack in the economy,” the Governor said on inflation. “A preemptive monetary policy response at this stage may kill the nascent and hesitant recovery that is trying to secure a foothold in extremely difficult conditions.”

He also said the available data point to exogenous and largely temporary supply shocks driving the inflation process, “validating the MPC decision to look through it.”

Economic growth in recent months has shown signs of recovery compared to the massive contraction witnessed in the first wave of COVID last year. After a 7.3 per cent contraction in 2020-21, the GDP growth is expected to pick up in the current fiscal.

Stating that the recovery remains uneven across sectors and needs to be supported by all policymakers, Das said RBI remains in “whatever it takes” mode, with a readiness to deploy all its policy levers — monetary, prudential or regulatory.

While some high-frequency data such as registration of automobiles, electricity demand, non-oil non-gold imports and consumer durables sales have shown quick rebound after easing of the COVID-related containment, RBI believes nurturing growth has to be a priority.

“While the government has taken certain steps to ease supply constraints, concerted efforts in this direction are necessary to restore supply-demand balance. The nascent and hesitant recovery needs to be nurtured through fiscal, monetary and sectoral policy levers,” the policy statement said.

Das cautioned against the threat of a likely third wave of the pandemic and assured that the central bank will remain vigilant. “The need of the hour is not to drop out the guard and remain vigilant against any possibility of third-wave especially in the backdrop of rising infections in certain parts of the country.”

Other measures announced include extending an on-tap Targeted Longer-Term Refinancing Operations programme, which allows banks to lend to stressed businesses, by three months to December 2021.

Under TLTRO, banks can draw liquidity as per need to on-lend to needy segments. When it was announced on October 9, 2020, the on-tap TLTRO scheme covered five sectors. The scope was extended to stressed sectors identified by the Kamath Committee in December 2020 and bank lending to NBFCs in February 2021.

Also, guidelines on export credit in foreign currencies were amended and the deadline to hit targeted milestones under debt recast plans was extended by six months to help businesses impacted by the pandemic.

Similarly, the RBI has extended the relaxation given to banks on the marginal standing facility (MSF) till December 2021. On March 27, 2020, RBI allowed banks to avail funds under the MSF. With the extension, banks will have increased access to funds to the extent of Rs 1.62 lakh crore, Das said.

PTI