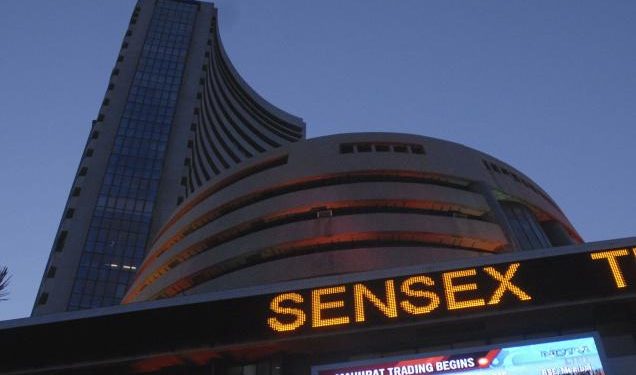

Mumbai: Domestic equity benchmark BSE Sensex plunged over 400 points in early trade Monday amid heavy foreign fund outflow and weak domestic as well as global cues.

The 30-share index was trading 373.14 points or 0.97 per cent lower at 37,963.87 at 0930 hours; and the broader Nifty also sank 116.80 points or 1.02 per cent to 11,302.45.

In the previous session, the 30-share index cracked 560.45 points or 1.44 per cent to settle at 38,337.01. Similarly, the broader NSE Nifty sank 177.65 points or 1.53 per cent to 11,419.25. This was the second-biggest fall for the Sensex in 2019. The index had plunged 792.82 points July 8 following the Budget.

In early trade, HDFC Bank was among the top losers in the Sensex pack, cracking up to 3 per cent, after the lender reported a rise in non-performing assets (NPAs).

During the quarter, gross NPAs rose to Rs 11,768.95 crore which is 1.40 per cent of the total advances, compared with Rs 9,538.62 crore which was 1.33 per cent in the same quarter 2018-19 fiscal.

Other losers included Bajaj Finance, HDFC, IndusInd Bank, Kotak Bank, ONGC, HUL, ITC, NTPC, Bharti Airtel and ICICI Bank, falling up to 2.85 per cent.

On the other hand, Vedanta, Tata Motors, Yes Bank, Sun Pharma, Hero MotoCorp, Asian Paints and Maruti were among the top gainers, rising up to 3.54 per cent.

On a net basis, foreign institutional investors sold equities worth Rs 950.15 crore, while domestic institutional investors purchased shares to the tune of Rs 733.92 crore, provisional data available with stock exchanges showed Friday.

According to experts, the selloff by foreign funds was due to the government’s reluctance to tweak foreign portfolio investors (FPIs) income tax surcharge.

The deficiency in monsoon rain and weak corporate earnings have also impacted the risk sentiment, they said.

With domestic investors already battling concerns of a slowing economy, markets are witnessing broad-based selling, said Sunil Sharma, Chief Investment Officer, Sanctum Wealth Management.

“The market reaction post the BJP victory in 2019 is in stark contrast to the bullish tenor in 2014, and market participants expecting a repeat of 2014 are clearly disappointed, he added.

Meanwhile, the Indian rupee depreciated 22 paise (intra-day) to 69.02 against the US dollar.

The global oil benchmark Brent crude futures were trading 1.34 per cent higher at 63.31 per barrel.

Elsewhere in Asia, Shanghai Composite Index, Hang Seng, Nikkei and Kospi were trading in the red in their respective early sessions.

PTI