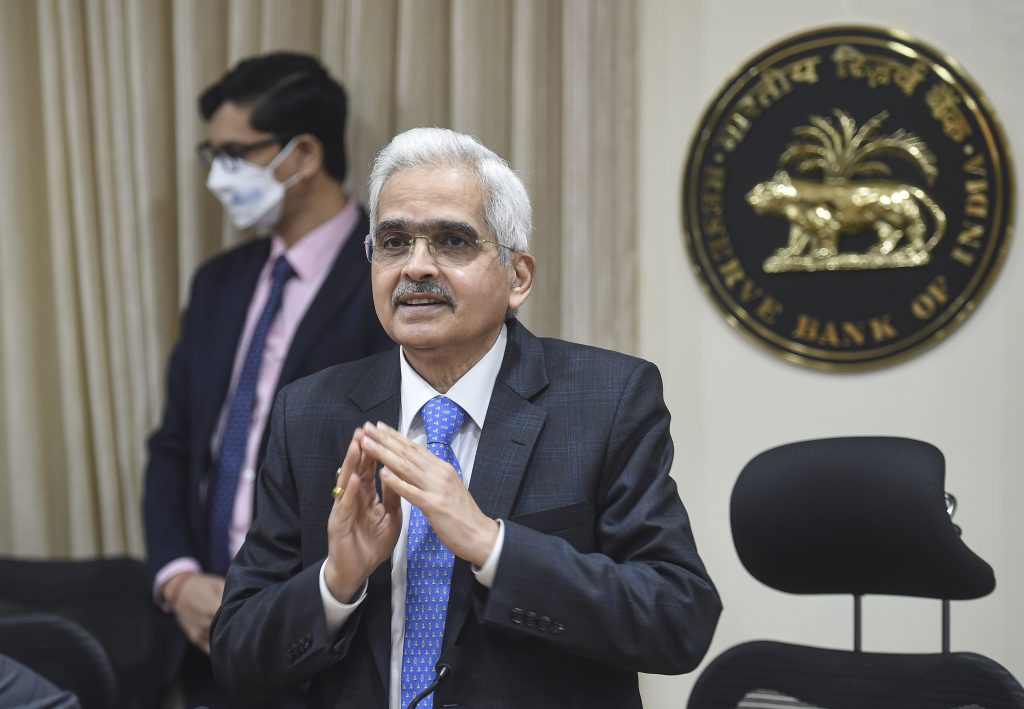

Mumbai: The world is in the eye of a new storm but the domestic economy is resilient. That is how RBI governor Shaktikanta Das opened his post-policy presser Friday afternoon, listing the third shock facing the global economy after the pandemic and Ukraine war.

Earlier in the day, the RBI-led monetary policy committee (MPC) delivered the third straight 50-bps repo rate hike. The new hikes took the overall increase in the federal fund rates by 190 bps to 5.90 per cent – the highest since April 2019. Also going by all indications, they aren’t done yet as inflation remains much above its tolerance level for the eighth month on the trot.

Yet, earlier in the day, the MPC-RBI lowered the growth forecast for the second time to 7 per cent — down from 7.8 per cent in April and 7.2 per cent in August.

“In the last two-and-a-half years, the world has witnessed two major shocks – the Covid-19 pandemic and the conflict in Ukraine. These shocks have produced profound impact on the global economy. As if that was not enough, now we are in the midst of a third major shock – a storm – arising from aggressive monetary policy actions and even more aggressive communication from advanced economy central banks like the US Fed,” Das said in his policy address.

“While the necessity of such actions is driven by their domestic considerations, in a highly integrated global financial system, they inevitably cause negative externalities through global spillovers and we in the emerging markets will have to suffer the consequences. We aren’t blaming them for what they are reacting to their domestic imperatives and we will have to deal with the spillovers,” Shaktikanta Das added.

Das noted that the recent sharp rate hikes and forward guidance for more hikes have tightened financial conditions, extreme volatility and risk aversion. He said all segments of the financial market including equity, bond and currencies are in turmoil across the globe. There is nervousness in financial markets with potential consequences for the real economy and financial stability. “The global economy is in the eye of a new storm,” Das reiterated.

However, the RBI governor sounded sanguine about the domestic economy, despite at a more cautious level saying ‘amidst this unsettling global environment, our economy continues to be resilient. There is macroeconomic stability our financial system remains intact, with improved performance parameters. We have withstood the shocks from the pandemic and the Ukraine conflict’.

Das said when currencies are in a free fall, imported inflation is an inevitable eventuality and the world is facing the same thing now and our forward guidance on prices factors in this aspect. The third shock has been accentuated by the advanced economy central banks steeply hiking rates and making forward guidance of sharper hikes which have already roiled the global financial markets creating excessive volatility in global currency markets.

Despite that optimism, the RBI lowered its GDP forecast to 7 per cent for the current fiscal (from 7.2 per cent in June and 7.8 per cent in April) citing global headwinds arising from the lingering Ukraine war the aggressive monetary policy tightening globally forced by multi-decade high inflation across the Western world.