New Delhi: Be ready to pay higher interest on your outstanding loan if you decide not to pay EMIs on your home or auto loan for the next three months under a moratorium announced by by the Reserve Bank of India Friday.

Analysts and experts tracking the sector said that simple interest rate would be calculated by banks for the three-month period in which loan repayment was due but was not paid under the moratorium. This would be added up into your EMIs at the end of three-month forbearance, raising your monthly bill.

So, if you’re deferring payment of an EMI of, say Rs 1,000, and the bank is charging interest at the rate 10 per cent on outstanding, you will end up paying Rs 25 extra on each of the three EMIs that has not been paid during the moratorium. This additional interest may either be added up to all your future EMIs or your loan tenure could get extended at the same EMI level.

“Whether the customers will have to pay this additional interest in one go or will be allowed to get it adjusted as additional EMI is something that needs to be clarified by banks,” said a financial sector analyst asking not to be named.

As a result of the moratorium, the tenure of such loans will get extended by three months which should be possible as floating rate loan contracts typically have a provision for extension of loan tenure.

If additional interest burden for three month amoratorium period is also equally divided in all future EMIs, the monthly bill for customer may increase or banks may decide to keep EMIs same but increase the tenure of loan by a few months.

“The 3-month EMI moratorium is a welcome move for those customers whose short-term cash flows are adversely affected by the coronavirus pandemic. This basically means that the customers may be allowed to defer their immediate EMI payments, but come June, they will have to resume the payments. It is not a waiver, but only a shift in payment schedules,” Kunal Varma, CBO and Co-Founder, MoneyTap said.

Customers who have the ability to pay (such as salaried professionals whose incomes are still intact) should compare their original cash flows with the revised repayment schedules and accrued interest payments, and then take a call on what makes the most sense for them, he added.

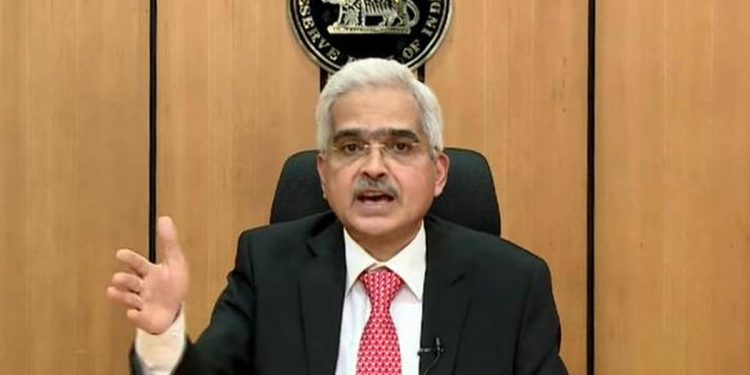

The Reserve Bank Governor Shaktikanta Das on Friday announced a three-month moratorium on EMIs of all term loans due during March 1 to May 31 and said that the repayment schedule for all those loans would be shifted by three months after the moratorium.

This will bring relief to all borrowers, including those who have home loans, auto loans, education loans, agricultural term loans, retail and crop loans to their names. It will also be applicable on credit card dues.

“In respect of all term loans (including agricultural term loans, retail and crop loans), all commercial banks (including regional rural banks, small finance banks and local area banks), co-operative banks, all-India Financial Institutions, and NBFCs (including housing finance companies) are permitted to grant a moratorium of three months on payment of all instalments falling due between March 1, 2020 and May 31, 2020,” said the RBI’s circular to all banks and non-banking financial companies.

“The repayment schedule for such loans as also the residual tenor, will be shifted across the board by three months after the moratorium period. Interest shall continue to accrue on the outstanding portion of the term loans during the moratorium period,” RBI said.

As of January-end, over Rs 13 lakh crore of housing loans and Rs 2 lakh crore of auto loans were outstanding, data with the Reserve bank of India shows.

Besides retail borrowers, micro, small and medium enterprises and large companies will also benefit from the RBI’s relaxation of loan repayment.