Dasarathi Mishra

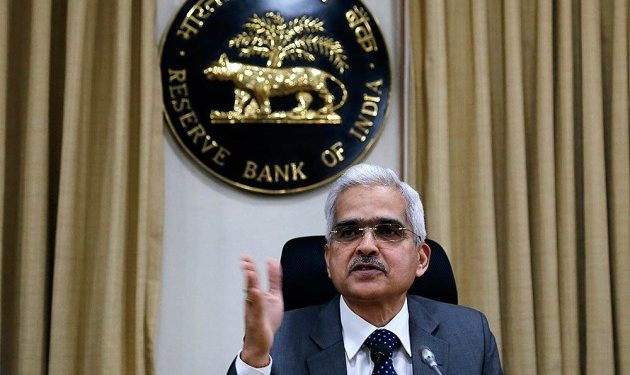

While releasing the Monetary Policy Statement earlier this month, RBI Governor Saktikanta Das sounded an optimistic note. He stated that, “Relative to pre-Covid levels, several high frequency indicators are pointing to the easing of contractions in various sectors of the economy and the emergence of impulses of growth.”

The Monetary Policy Committee has stated that economic activity is stabilizing in Q2 (July -September) after the 23.9 per cent year-on-year (y-o-y) contraction in real GDP in Q1 (April-June). Buttressed by government spending and rural demand, the manufacturing and some categories of services such as passenger vehicles and railway freight have gradually recovered in Q2. RBI reiterated that the focus must now shift from containment to revival. Clearly, RBI is on a path of pump-priming the economy.

The greenshoots are visible in rural economy. The rural economy looks resilient. Kharif sowing has surpassed last year’s acreage as well as the normal sown area. Early estimates suggest that food grains production is set to cross another record in 2020-21. Job creation under MNREGA has provided incomes and employment in rural areas. Meanwhile, migrant labour and semiskilled workers are returning to work in urban areas. Now, the focus of the government and central bank is on recovery. Recovery is bound to be sector-specific. Recovery is discernible in agriculture and allied activities, fast-moving consumer goods, two-wheelers, passenger vehicles and tractors, drugs and pharmaceuticals, and electricity generation, especially in renewables. So they are set for a V-shaped recovery.

Private investment and exports are likely to be subdued, especially as external demand is still anemic. If the current momentum of upturn gains ground, a faster and stronger rebound is eminently feasible. RBI has prioritised the orderly functioning of markets and financial institutions, easing of financing conditions and the provision of adequate system-level as well as targeted liquidity. Since February 2020, RBI has taken a series of steps in this direction. More would follow. RBI Governor has assured market participants that in keeping with the monetary policy stance announced on October 9, the central bank will maintain comfortable liquidity conditions and conduct market operations in the form of outright and special open market operations. In response to feedback from market participants, the size of these auctions will be increased to `20,000 crore.

RBI has decided to conduct on tap TLTRO with tenors of up to three years for a total amount of up to `1,00,000 crore at a floating rate linked to the policy repo rate. The scheme will be available up to March 31, 2021. Liquidity availed by banks under the scheme has to be deployed in corporate bonds, commercial papers, and non-convertible debentures issued by the entities in specific sectors. The liquidity availed under the scheme can also be used to extend bank loans and advances to these sectors.

Co-origination of loans by banks and a category of non-banking financial companies (NBFCs) for lending to the priority sector subject to certain conditions started in 2018 entailed joint contribution of credit at the facility level by both the lenders. This also helped in sharing of risks and rewards between them. RBI has decided to extend the scheme to all the NBFCs (including Housing Finance Companies) to make all priority sector loans eligible for the scheme and give greater operational flexibility to lending institutions. The proposed framework will be called “Co-Lending Model”.

Many experts and economists vouch for the next wave of economic reforms to steer the economy. A few areas could be as follows: One, we should not waste time in reforming the corporate bond market. With a developed bond market, the corporate sector can directly source their funding requirement from the market. To that extent, corporates will move from banking sector to financial market/ investors for raising funds. Two, recently the SEBI has permitted commercial papers to be traded on stock exchange. This is a step in the right direction. Three, the G-Sec market is very huge but participation of small investors is almost non-existent. Retail investors should be encouraged to participate in G Sec market.

The writer is a former CGM, RBI. Views are personal.