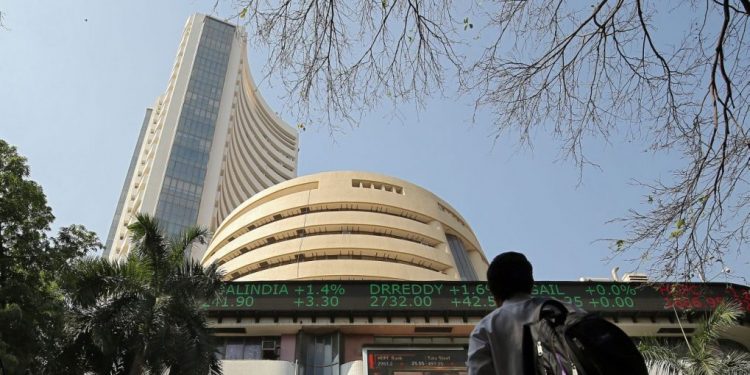

Mumbai: Equity benchmarks BSE Sensex and Nifty closed marginally higher in a volatile session Tuesday as fag-end buying in auto, industrial and commodity stocks helped the indices extend gains for a third straight day.

Investors also preferred to stay on the sidelines ahead of the Reserve Bank of India’s interest rate decision later this week, traders said.

After a see-saw session, the 30-share BSE Sensex eked out marginal gains of 5.41 points or 0.01 per cent to settle at 62,792.88. During the day, it hit a high of 62,867.95 and a low of 62,554.21.

The NSE Nifty went up by 5.15 points or 0.03 per cent to end at 18,599.

“Markets remained volatile and ended almost unchanged amid mixed cues. After the flat start, the Nifty drifted lower as the day progressed. However, a sharp recovery in the last half an hour trimmed all the losses. Eventually, Nifty settled closer to the day’s high at 18,599 levels,” said Ajit Mishra, SVP – Technical Research, Religare Broking Ltd.

UltraTech Cement was the biggest gainer in the Sensex chart, climbing 3.13 per cent, followed by Kotak Mahindra Bank, Tata Motors, Axis Bank, Maruti, Bajaj Finserv, Bajaj Finance and Mahindra & Mahindra.

In contrast, Infosys, Tech Mahindra, Tata Consultancy Services, Wipro, Bharti Airtel, HCL Technologies, ICICI Bank and Nestle were among the laggards.

“While the markets ended flat, buying was seen in rate-sensitive stocks like banking, auto and realty ahead of the RBI’s MPC meet later this week. With expectations rising that the central bank could once again take a pause on rate hikes, hopes of steady interest rates going ahead triggered optimism in the rate-sensitives,” Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities Ltd, said.

In the broader market, the BSE smallcap gauge climbed 0.42 per cent and the midcap index gained 0.29 per cent.

Among the indices, IT fell 1.66 per cent, teck (1.51 per cent), metal (0.45 per cent), oil & gas (0.08 per cent) and FMCG (0.02 per cent).

Realty jumped 1.25 per cent, auto climbed 1.10 per cent, commodities (0.74 per cent), capital goods (0.61 per cent), and healthcare (0.59 per cent).

“A gauge of Indian IT stocks declined the most in seven weeks after a US-based peer – EPAM Systems cut its revenue growth forecast, warning of a slowdown in dealmaking,” Deepak Jasani, Head of Retail Research, HDFC Securities, said.

Global stock markets were mostly down Tuesday after Wall Street fell on concern the US economy may be weakening following a report that showed growth in service industries slowing, Jasani added.

In Asian markets, Tokyo ended in the green, while Shanghai and Hong Kong settled lower.

Equity markets in Europe were trading in negative territory. The US markets ended lower on Monday.

“The domestic market experienced profit-booking due to selling pressure in the IT sector. IT stocks witnessed a decline in anticipation of further downward revision in spending. However, a rally in auto and banks helped to recover the losses.

“Going ahead an important influencer will be the commentary on growth and inflation forecasts by the RBI following its MPC meeting, given the general consensus that rate pause will continue,” said Vinod Nair, Head of Research at Geojit Financial Services.

Global oil benchmark Brent crude declined 1.84 per cent to $75.33 a barrel.

Foreign Institutional Investors (FIIs) offloaded equities worth Rs 700.98 crore Monday, according to exchange data.

“Indian equities are facing a struggle at higher levels. FIIs too have been sellers for the past 3 days, thus capping the upside. With the RBI policy outcome now nearing, we expect the market to remain cautious in the near term with the action shifting to interest-sensitive sectors,” Siddhartha Khemka, Head – Retail Research, Motilal Oswal Financial Services Ltd, said.

PTI