New Delhi: Hailing the RBI’s decision to cut lending rate by 0.25 per cent as a welcome step to boost demand and revive economy, industry chambers Thursday said there is more room to slash rates further.

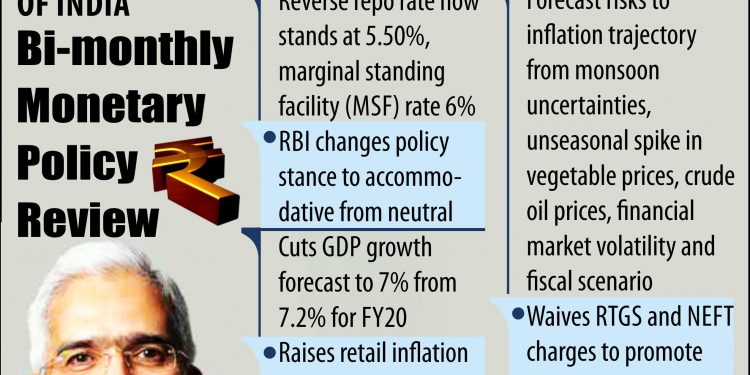

The Reserve Bank of India cut the repo — short term lending rate at which it gives loan to banks — third time in a row to 5.75 per cent in its second bi-monthly policy decision, adopting an accommodative stance.

“There is room for further rate cut…this third consecutive rate cut in repo rate will lead to effective transmission, encouraging banks to lower their lending rates for both retail and corporate credit,” said, President, Ficci.

Taking cues from the global factors as well as recent government data that estimated India’s GDP growth to a five-year low of 6.8 per cent in 2018-19, the RBI has also revised downward the economic expansion to 7 per cent from 7.2 per cent earlier for the current fiscal.

Reviving business confidence, consumer confidence and triggering animal spirits in the economy is the need of the hour, the chamber said in a statement.

“Going forward, while RBI should continue the accommodative stance in coming months, the new Government should present a progressive Union Budget that would help revive consumption and encourage greater private investments,” Somany said.

Assocham said the shift in policy stance from neutral to accommodative is looking significant and these measures would rekindle economic growth and improve business sentiments.

“The credit policy resolution and the RBI Governor’s emphasis on faster and higher transfer of rate cuts will be reassuring if done by the banks. This, when coupled with improved liquidity, would reduce the cost of borrowing,” said Assocham President B K Goenka.

The industry body’s Senior Vice-President Niranjan Hiranandani said the cut in repo would provide momentum to the market, but more needs to be done to address the issue of liquidity.

“Liquidity is very low as the borrowing cost is still very high. This liquidity crisis is taking a toll on the health of the companies and further inflicting financial damage thereby affecting the credit rating of companies and industries. Unless things are passed down, the NPAs of the banks would pile up in the near future,” he added.

PHD Chamber also welcomed the rate cut and said it will help to stimulate demand, boost investments, enhance exporters’ competitiveness and growth of the industrial sector.

While common man will be benefited with softening of EMIs on loans, the ripple effect of rate cut will enable small business to fulfil their credit requirements, the industry lobby said in statement.

“At this juncture, the transmission of the policy rate cut by the banking sector in terms of reduced lending rates would be crucial to boost liquidity. Going ahead, we expect repo rate to come down to 5 per cent in the coming quarters for adequate availability of credit to the industry especially to the MSMEs sector,” the chamber said.