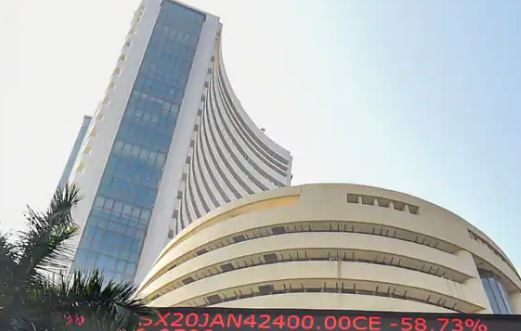

New Delhi: Dalal Street had a roller coaster ride in 2024 from shattering record after record to facing heavy correction off-late but equity markets still rewarded investors with positive returns, driven by a surge in domestic fund flows and a resilient macro landscape.

The first half of the year saw robust corporate earnings, a surge in domestic flows, and a resilient macro landscape, driving the Nifty to an all-time high of 26,277.35 in September 2024, according to Motilal Oswal Wealth Management.

“In the last two months, the market has corrected from its all-time high. This correction marked the third major decline since the COVID-19 pandemic in 2020, with unprecedented selling by Foreign Institutional Investors (FIIs) due to a combination of domestic and global factors,” it said in a note.

As of December 27, the BSE benchmark Sensex has gained 6,458.81 points or 8.94 per cent while the NSE Nifty climbed 2,082 points or 9.58 per cent. The year was marked by significant events, with the Indian general elections and the US Presidential polls taking centre stage.

Equity markets also grappled with two major geopolitical turmoil — the Israel-Iran conflict and the ongoing Russia-Ukraine war.

“2024, was a year of tug of war between the bulls & bears marked by volatility majorly driven by global microeconomic data points followed by geopolitical tensions impacting markets. Despite all the uncertainties around the world, Indian markets sustained the pressure and delivered very decent returns.

“It was also a year of surge in valuation to the peak making Indian markets the most expensive in the world. While the excess liquidity in the market pushed valuations as high as possible surpassing fundamentals theories which eventually invited corrections in the markets from the top,” Prashanth Tapse, Senior VP Research, Research Analyst, Mehta Equities Ltd, said.

The BSE benchmark Sensex hit its record peak of 85,978.25 September 27 this year, and the NSE Nifty also reached the lifetime high of 26,277.35 on the same day.

“2024 marked the ninth consecutive year of gains for the Indian equity market. Despite a challenging final quarter, the market delivered strong returns for the year, with midcap and smallcap stocks outperforming and rewarding investors handsomely.

“However, benchmark indices like the Nifty and Sensex lagged behind their global counterparts, particularly the US markets. This underperformance was largely driven by persistent and aggressive selling by FIIs,” Santosh Meena, Head of Research, Swastika Investmart Ltd, said.

From the all-time highs in September, the BSE benchmark is down 8.46 per cent while Nifty has lost 9.37 per cent from the record peak level.

The challenges deepened in the final quarter as disappointing corporate earnings and weaker-than-expected economic growth further dampened investor confidence, contributing to the subdued performance of the headline indices, Meena said.

Markets came under bear attack from October onwards amid concerns of foreign investors fleeing the domestic market and stretched valuations.

In October alone, the BSE benchmark slumped 4,910.72 points or 5.82 per cent, and the Nifty tumbled 1,605.5 points or 6.22 per cent.

So far in December, the benchmark gauge Sensex is down 1,103.72 points or 1.38 per cent.

October saw an unprecedented foreign fund outflow of Rs 94,017 crore — the largest monthly withdrawal on record — amid increased allocations to China, muted corporate earnings, and high valuation of Indian stocks.

“On a positive note, the commencement of the rate cut cycle in the US provided a key tailwind for global equity markets. However, the Indian equity market faced headwinds due to record levels of aggressive selling by FIIs. Adding to the challenges, disappointing Q2 earnings by India Inc. and a slowdown in GDP growth further dampened investor sentiment,” Meena said.

In 2023, the BSE benchmark jumped 11,399.52 points or 18.73 per cent, and the Nifty climbed 3,626.1 points or 20 per cent.

This year, apart from the general elections in India, markets saw tight rate cycle by RBI to tackle inflation, unwinding of Yen carry trade, rate cut by the US FED, election in the US and Trump getting elected as the President of the US and stimulus by China, Manish Bhandari, CEO & Portfolio Manager, Vallum Capital Advisors, said.

The recent market correction has improved valuations, and the overall outlook for the Indian equity market remains robust, Meena said.

“On the global front, the trajectory of the world economy under Trump’s leadership will play a significant role in shaping investor sentiment and market dynamics. Additionally, FII flows will remain a crucial factor in determining the performance and direction of largecap stocks, given their outsized influence on market sentiment,” he added.

“Factors dependent for growth would again be similar to last year like geopolitical tussle, US Fed interest rate trajectory and Donald Trump’s tariff policies along with revival of local corporate earnings followed by domestic government policies to support growth. High focus would be on the dynamic relationship between the US and China,” Tapse of Mehta Equities Ltd, said.

PTI