Mumbai: After a subdued trade in the week gone by, the Indian equity market is likely to be largely impacted by progress in the US-China trade talks, and also developments in the country’s macroeconomic front in the coming days, analysts said. As the earnings season ended last week, the markets would look for news factors from here on, they said.

“Indian equity markets were lacklustre and range-bound this week. Market sentiments turned somewhat negative post weak macroeconomic data releases throughout the week, Moody’s Investors Service cut in its rating outlook for India and the absence of fresh triggers in near term. Weak macro data (IIP, CPI Inflation) raised concerns on the growth outlook of the economy,” said Siddhartha Khemka, Head of Retail Research at Motilal Oswal Financial Services.

“The earnings season came to an end today and thus the focus from next week will shift to the measures (both fiscal and sector specific), that the government is likely to take to revive growth. Investors would also keep a watch for GDP data to be released at month-end and clarity over the US-China trade deal which would give direction to the markets,” he added.

GDP data for the quarter-ended September will be released November 29 and expectations are that the growth numbers are likely remain subdued after the first quarter GDP growth rate declined to a six-year low of 5 per cent.

Khemka said that the the real GDP growth may fall to 4.6 per cent in the second quarter. On the global front, apart from the trade talks, the minutes of the Federal Open Market Committee’s (FOMC) meeting of the US Federal Reserve scheduled to be released November 20 would also have its impact on both global and Indian equity market sentiments.

Last week, the markets traded on a subdued note, with weak market sentiments over the slowing economy along with profit booking post the highs reached in previous weeks.

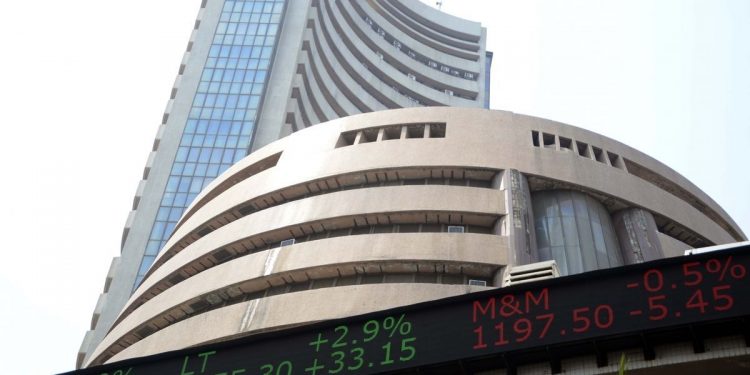

The BSE Sensex, Friday, closed at 40,356.69 points, higher by 70.21 points, or 0.17 per cent, over its previous close and the Nifty50 on the National Stock Exchange settled at 11,895.45, higher by 23.35 points, or 0.20 per cent, than its previous close. “Nifty witnessed strong resistance above 12,000 levels and ended this week on a flat note. Profit booking was seen at higher levels, given the downgrade in India’s rating and weak macros. Investors were concerned over the premium valuation of large cap stocks, while mid and small cap may catch up in the medium-term as the economy improves,” said Vinod Nair, Head of Research at Geojit Financial Services. Weak economic data and concerns over slowdown in earnings growth was hurting investor sentiments. Despite series of rate cut by RBI, core sector growth remained muted and the retail inflation inched higher, he said, Nair added.

The domestic macros are not providing confidence to investors, Nair said, adding that the recent steps from the government and the Reserve Bank of India (RBI) to push growth would soothe investors nerves.