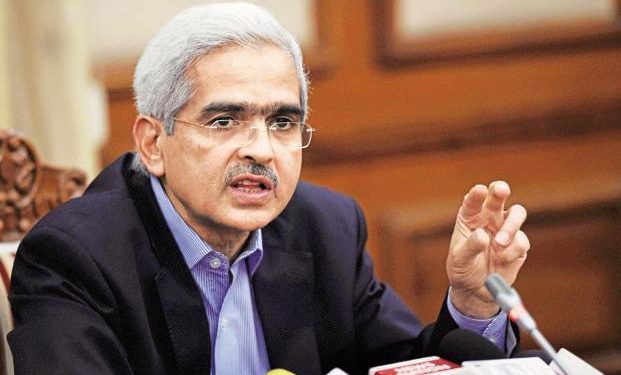

New Delhi: The one year of Reserve Bank of India (RBI) Governor Shaktikanta Das has been quite action-oriented with new approach and policies. That’s the broadly held view. However, it comes with some riders, particularly about his decisions.

There are diverse views on the RBI governor’s first-year stint at the Mint street on his policies and approach. While some senior ex-government officials feel the perception on the reserves transfer to the government shows little of the RBI’s strong side, others say it was done as per the RBI Act.

Some officials said Das certainly changed the RBI’s confrontationist image and has taken ‘growth alongside inflation’ as the key parameter where it has a responsibility along with the government.

Das was appointed the RBI Governor when Urjit Patel, his predecessor, suddenly quit after a series of public spat with the government.

In the past one year, Das infused liquidity into the non-banking financial companies (NBFCs) and the housing finance companies (HFCs), cut the repo rate by 135 basis points (bps) to push growth, put in place a new non-performing assets (NPAs) framework, transferred Rs 1.76 lakh crore to the government kitty without any acrimony and revised growth rates downwards. But more importantly, he didn’t wash the dirty linen in public by keeping differences with the Finance Ministry away from the media glare.

“With this Governor, the RBI has started taking the stakeholders’ input into consideration, at least by lending them an ear, and if necessary, showed no hesitation in implementing them. The major difference, which has come now (with Governor Das), is that the RBI’s indifference to anything other than inflation has changed. The problem with the previous regime was that there was no willingness to meet at all,” said S.S. Mundra, former RBI Deputy Governor.

Stating that the monetary and the fiscal authorities have to be in constant dialogue to take the economy forward, Mundra said but that cordial relationship didn’t mean that you have to say yes to the government all the time. “There have many instances of the RBI putting its foot down and being able to put its point across. Things start deteriorating with open criticism. As long as you do it through the backdoor channel and put the argument across it works quite well. The present Governor has been successful in doing this,” Mundra said.

According to Subhash Chandra Garg, ex-Finance Secretary, the RBI and the government had well-defined responsibilities but they do overlap. “Thus, coordination between the RBI and the Finance Ministry is extremely important. They don’t function in isolation and do coordinate. But there are phases, depending upon the persons involved and the economic and financial situations when the coordination is either weak or strong or positions and views at variance,” Garg said.

Hailing Das for the 135bps cut in repo rate, Garg said it was still high compared with global rates. “There should be more active on it. The RBI should push for more repo rate cuts and also ensure better transmission,” the ex-Finance Secretary said.

Mundra said previous rate cuts were aimed at the supply side constraints and improving liquidity, but reductions had not transmitted to borrowers as the banking system itself was in deep stress and “remains cautious of lending”.

“There are structural rigidities in the bank lending rates and the RBI is wrong to force lenders to transmit the whole of repo rate cuts. Small savings rates are also high. So the RBI is trying to link it to the external benchmark for banks. By external benchmarks, some retail loans may become cheap, but it won’t affect corporate loans,” he said.

If transmission was forced too much, it would create pressure on banks. For example, in an informal rural economy mere rate cut to bring down retail lending rates wouldn’t spur growth as much as in a formal economy, Mundra said.

Ex-Finance Secretary Arvind Jayaram asked how banks could transmit lower repo rates to borrowers when their balance sheets were stressed. Unless these banks were adequately recapitalised and some backstopping on the bad loans done, the transmission would be impossible in the manner the RBI wanted, he said.

Former government officials are also unanimous in their praise for the RBI for the manner it dealt with the decision to part with reserves. “It was handled sensibly, in a professional manner through a panel of experts. At the end, the RBI has given just Rs 35,000-37,000 crore extra. Even this figure is misleading as part of it could have been given in any case. As per the law, whatever is surplus, gets transferred to the government at the year-end. The Rs 1.05 lakh crore would have gone in any case,” said Mundra.

Acknowledgement of stress in the growth is another major development. While Urjit Patel focused more on inflation control, leaving the growth to suffer, even though there was substantial headroom to correct the rates, the Das-led RBI, for the first time, acknowledged that growth was as important for the RBI as for the government.

Mayaram, however, believes the RBI has not been able to diagnose what ails the economy, and there is also a soft perception on its handling of the surplus transfer.

Saying that the diagnosis by the RBI and the government as what ailed the economy has not been correct, Mayaram said, “We don’t have enough consumption, which is a demand-side issue. But reduction in repo rate and corporate taxes are supply-side remedy. It is not going to have much of an impact. The RBI doesn’t have the mandate or the capacity to be able to reverse a slowdown, it has to come from the fiscal policy.”

“We are not there as yet. On a regular basis, we need the RBI to have a strong balance sheet and the markets’ confidence that it can take decisions on its own”, said Mayaram.

While experts agree to disagree, the RBI’s role continues to be important.

(IANS)