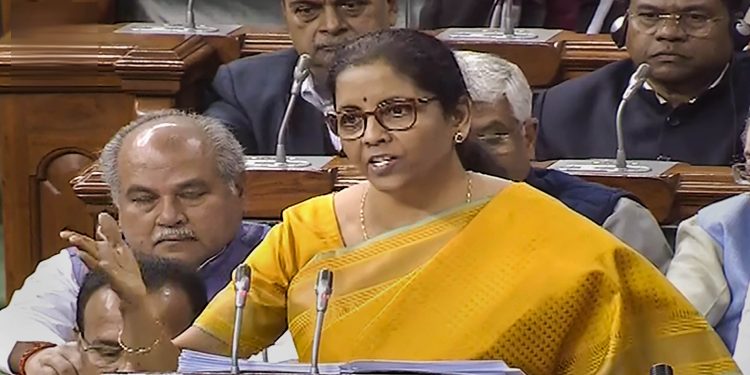

New Delhi: Finance Minister Nirmala Sitharaman announced Saturday cuts in personal income tax, extended tax benefits for affordable housing and gave relief to companies on payment of dividend in the Union Budget for 2020-21 as the government looked to boost consumption to bring the economy out of the worst slowdown in 11 years.

The minister proposed raising customs duty on a variety of products ranging from tableware and kitchenware, electrical appliances to footwear, furniture, stationery and toys to give a level playing field to domestic companies and boost ‘Make in India’.

Offering an optional lower rate of income tax to individuals, Sitharaman in her Budget for 2020-21 proposed new tax slabs of 15 per cent and 25 per cent in addition to the existing 10 per cent, 20 per cent and 30 per cent. The new I-T slabs would be for individuals not availing certain specified deductions or exemptions.

Under the proposed I-T slab, annual income up to Rs 2.5 lakh is exempt from tax. Those individuals earning between Rs 2.5 lakh and Rs 5 lakh will pay five per cent tax. Income between Rs 5,00,000 and Rs 7,50,000 lakh will be taxed at 10 per cent, while those between Rs 7.5 and Rs 10 lakh at 15 per cent. Those earning between Rs 10 and 12.5 lakh will pay tax at the rate of 20 per cent, while those between Rs 12.5 and Rs 15 lakh will pay at the rate of 25 per cent. Income above Rs 15 lakh will be taxed at 30 per cent.

Individuals opting for taxation under new rates will not be entitled to exemption/deductions including under Section 80C and 80D, LTC, housing rent allowance, deduction for entertainment allowance, professional tax, and interest on self occupied/vacant property.

“The new tax regime shall be optional for tax payers,” Sitharaman said. “The proposed tax structure will provide significant relief to taxpayers and more so to those in the middle class,” the finance minister added.

To boost growth, Sitharaman announced higher spendings on infrastructure, rural development and agri sector. The Finance Minister said the government is proposing a 16-point action plan to boost agriculture and farmers’ welfare.

Agricultural services need copious investments, she said, adding government has insured 6.11 crore farmers under the Pradhan Mantri Fasal Bima Yojna.

With her post 2019-20 Budget corporate tax cut drilling a Rs 1.45 lakh crore hole in government revenues, the minister hiked the fiscal deficit target for current fiscal to 3.8 per cent of GDP, from 3.3 per cent. For 2020-21, she pegged the fiscal deficit at 3.5 per cent.

New Delhi: Following are the highlights from the 2020-21 Union Budget.

Proposes new income tax structure for individuals willing to forego certain exemptions and deductions

Under the new structure, income of Rs 5-7.5 lakh to attract 10 per cent tax, Rs 7.5-Rs 10 lakh 15 per cent, Rs 10-12.5 lakh 20 per cent, Rs 12.5-15 lakh 25 per cent, above Rs 15 lakh 30 per cent

Income up to Rs 5 lakh to remain exempt from tax

Bank deposit insurance coverage increased to Rs 5 lakh from Rs 1 lakh

Dividend Distribution Tax at the hands of companies abolished; dividend to be taxed at the hands of recipients as per applicable slab

Government to sell part of stake in LIC through IPO

Fiscal deficit for FY20 estimated at 3.8 per cent, up from 3.3 per cent projected earlier

Fiscal deficit for 2020-21 projected at 3.5 per cent

2020-21 net market borrowing pegged at Rs 5.36 lakh crore

Disinvestment proceeds pegged at Rs 1.20 lakh crore for 2020-21, up from Rs 65,000 crore in current fiscal

Receipts estimated at 22.46 lakh crore, expenditure at Rs 30.42 lakh crore in 2020-21 based on nominal GDP growth of 10 per cent

PAN to be allotted instantly on the basis of Aadhaar card

Central government debt reduced to 48.7 per cent of GDP in March 2019, from 52.2 per cent in March 2014

Proposal to sell the balance government holding in IDBI Bank to private, retail and institutional investors through stock exchanges

Defence outlay pegged at Rs 3.23 lakh crore in 2020-21, up from Rs 3.16 lakh crore this financial year

Railways to set up ‘Kisan Rail’ through PPP

Krishi Udaan will be launched by Civil Aviation Ministry on international and national routes

Outlay for agriculture and allied activities pegged at Rs 2.83 lakh crore, Nabard’s re-finance scheme to be further expanded

Agriculture credit target for the year 2020-21 set at Rs 15 lakh crore

Health sector and Swachh Bharat outlay pegged at Rs 69,000 crore and Rs 12,300 crore, respectively, in 2020-21

New Education Policy to be announced soon

Steps would be taken to enable sourcing external commercial borrowings and FDI in higher education

Rs 99,300 crore outlay for the education sector in 2020-21 and Rs 3,000 crore for skill development

Proposes ‘Investment Clearance Cell’ to provide ‘end-to-end’ facilitation and support, including pre-investment advisory, information related to land banks and facilitate clearances at Centre and state level

Proposes a scheme focused on encouraging manufacture of mobile phones, electronic equipment and semi-conductor packaging

National Technical Textiles Mission proposed with a 4-year implementation period from 2020-21 to 2023-24 at an outlay of Rs 1,480 crore

NIRVIK scheme being launched to provide for higher insurance coverage, reduction in premium for small exporters and simplified procedure for claim settlements

National Logistics Policy to be released soon, to create a single-window e-logistics market and focus on employment generation

Delhi-Mumbai Expressway would be completed by 2023, work on Chennai-Bangalore Expressway would also be started

The government would consider corporatising at least one major port and, subsequently, its listing on bourses

Rs 1.70 lakh crore outlay for transport infrastructure in 2020-21

Urges States and UTs to replace conventional energy metres by prepaid smart metres in the next 3 years to give consumers the freedom to choose the supplier. Further, measures to reform Discoms would be taken

Rs 22,000 crore outlay for the power and renewable energy sector in 2020-21

Proposes to expand the national gas grid from the present 16,200 km to 27,000 km

Policy to enable private sector to build data centre parks throughout the country soon

Rs 6,000 crore outlay to the BharatNet programme in 2020-21

Proposes a task force to recommend on women’s marriageable age

Budget allocation of Rs 85,000 crore for Scheduled Castes and Other Backward classes, Rs 53,700 crore for Scheduled Tribes for 2020-21

Amendments proposed in Companies Act

Rs 30,757 crore allocated to Union territories of J&K and Ladakh

Govt to ask RBI to allow MSMEs to restructure debt till March 31, 2021

FPI limit in corporate bonds hiked to 15 per cent of outstanding stock, from nine per cent

New debt-ETF, consisting primarily of government securities, to be floated

* Proposes lower tax rates for cooperatives at 22 per cent with 10 per cent surcharge and 4 per cent cess.

Agencies