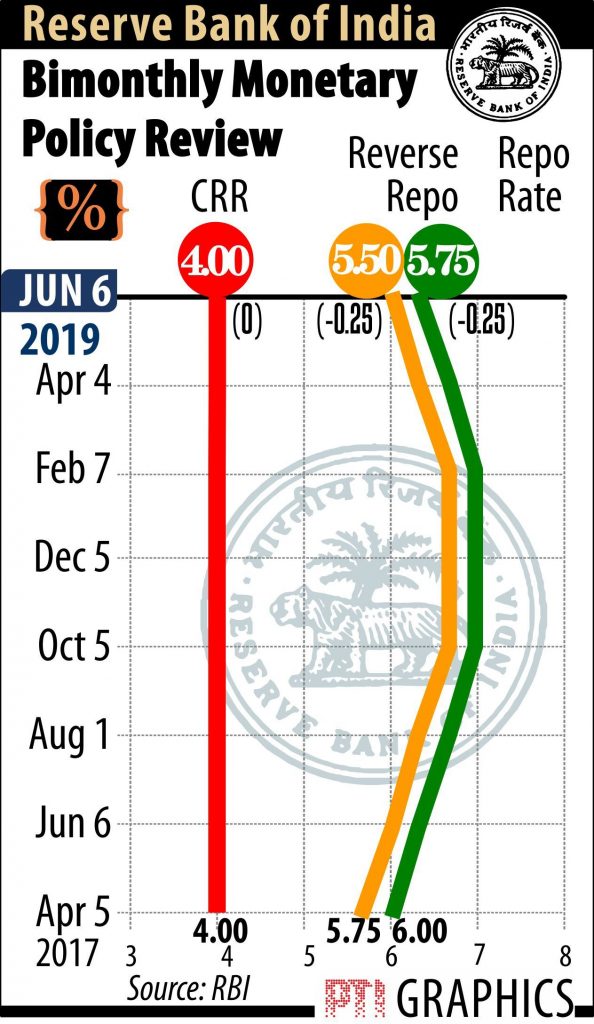

The Reserve Bank of India cut repo rate by 25 basis points Thursday — the third consecutive time that the bank has done it following bi-monthly meetings of the Monetary Policy Committee. It has also changed the policy stance from ‘neutral’ to ‘accommodative’, indicating the possibility of further cuts in future. With the rate cut, there has been a 75 basis points reduction in policy rate thus far in 2019. The reduction is expected to trickle down to benefit the common man. The government, too, is obviously targeting growth. The formation of two Cabinet panels aimed at spurring growth and generating jobs was an indicator of the government’s concerns about the economic situation and the direction it intends to take. The Central Bank’s decision has been on expected lines, given that the country’s growth rate has slipped to a five-year low of 5.8 per cent in the quarter that ended March 31. Poor performance of agriculture and manufacturing has led to the slowing. That also meant India was beaten by China to the status of fastest growing major economy as that country clocked growth rate of 6.4 per cent in the same quarter. The Reserve Bank has also lowered its GDP target for the financial year 2019-20 from 7.2 per cent to 7 per cent in line with the change. A concomitant point of concern is that the employment data finally released by the labour ministry has corroborated a report leaked before the general elections, showing that unemployment rate in 2017-18 was 6.1 per cent — a 45-year high.

The RBI’s action, however, can have any effect only if banks pass on the rate cut. But lenders have not adjusted their lending and deposit rates in tune with the 50 basis points rate cut effected by the RBI following the first two policy reviews this year; several of them have, in fact, raised deposit rates to mobilise funds. But lenders have been finding it hard to mobilise investment, given that government borrowing has increased and small savings rates continue to be high. Banks are also struggling with high NPAs, while NBFCs are facing solvency issues which have led to a credit-freeze. It is also unlikely that banks will let their guard down and boost credit in the kind of milieu that has been created by big-ticket defaults.

A bigger issue to tackle is demand. The country has been witnessing a slump in demand across sectors. It could take fiscal policy changes to spur demand, particularly among the middle-class. Extra care will be required to support the agricultural sector, considering that meteorological predictions hint at a weak monsoon. With the RBI continuing with rate cuts, the possibilities of the government announcing tax cuts at the coming budget, too, are brightening. It is vital that both institutional and individual demand is boosted. The fact that inflation has been undershooting the RBI’s target of four per cent for nine months consecutively owes also to weakening demand. The worry in the scenario is also whether the finance minister has the room to give the economy a stimulus given the fiscal constraints the country is facing on account of the schemes announced before elections, and their expansion after the government resumed power. External factors such as the US-China trade war and India’s own equations with the US, and possible rise in the oil bill with supply from Iran and Venezuela being stopped, will also play crucial part in how the situation pans out. The government will have to find a way around all these challenges to put the country back on track to growth.