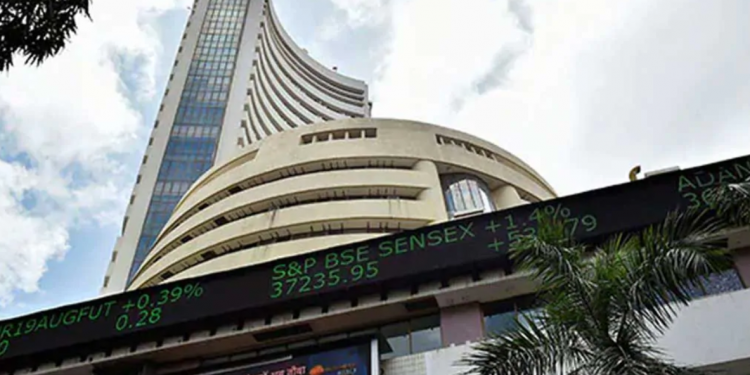

Mumbai: Equity benchmark indices Sensex and Nifty opened marginally higher Friday ahead of the Reserve Bank of India’s monetary policy decision.

The 30-share index was trading 54.98 points or 0.10 per cent higher at 54,547.82, while the broader NSE Nifty inched 17.50 points or 0.11 per cent higher to 16,312.10.

The RBI will announce its bi-monthly monetary policy amid expectations that it may opt for status quo on interest rates on account of inflationary concerns.

IndusInd Bank was the top gainer in the Sensex pack, rising around 3 per cent, followed by M&M, Maruti, Bharti Airtel, Sun Pharma and NTPC.

On the other hand, HCL Tech, Titan, Nestle India and Infosys were among the laggards.

In the previous session, Sensex settled 123.07 points or 0.23 per cent higher at its new closing record of 54,492.84, and Nifty rose 35.80 points or 0.22 per cent to its lifetime peak of 16,294.60.

According to V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services, there are two major factors supporting the ongoing bull run: one, the strength of the mother market the US, riding on the support from huge liquidity and highly accommodative monetary stance of the Fed; two, the exuberance of the retail investors who are exerting a disproportionate influence on market movements.

“While retail investor participation is a desirable trend, it is important to note the fact that the quality of retail investment – chasing low-quality cheap stocks – leaves a lot to be desired. In the long run, the majority of retail investors will be better- off investing through mutual funds,” he said.

Meanwhile, foreign institutional investors (FIIs) were net sellers in the capital market as they offloaded shares worth Rs 719.88 crore on Thursday, as per provisional exchange data.

Elsewhere in Asia, bourses in Shanghai, Hong Kong and Seoul were in the red in mid-session deals, while Tokyo was trading with gains.

Equities on Wall Street largely ended on a positive note in overnight trade.

Meanwhile, international oil benchmark Brent crude advanced 0.14 per cent to USD 71.39 per barrel.