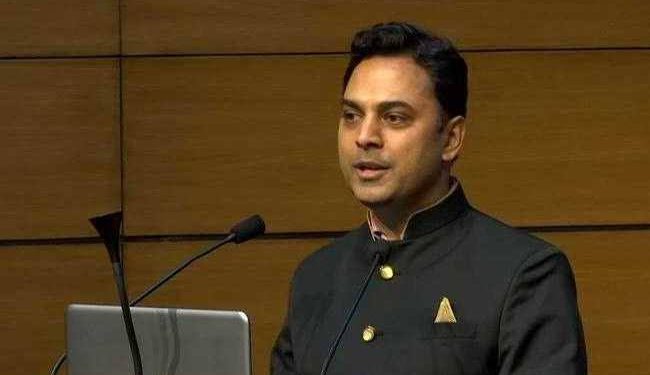

New Delhi: Asserting that the disinvestment target of Rs 1.75 lakh crore for 2021-22 was ‘imminently achievable’, Chief Economic Adviser (CEA) K V Subramanian Saturday said the proposed initial public offering (IPO) by LIC itself could garner Rs 1 lakh crore for the government.

He also said retail inflation targeting by the Reserve Bank of India (RBI) has helped in bringing down the volatility and level of inflation.

The RBI’s Monetary Policy Committee has been mandated to maintain annual inflation at 4 per cent until March 31, 2021, with an upper tolerance of 6 per cent and lower limit of 2 per cent.

Speaking at a virtual conference by Jana Small Finance Bank, Subramanian said the disinvestment target of Rs 1.75 lakh crore for 2021-22 is actually a carry over of the Rs 2.10 lakh crore target set for the current fiscal ending March 31.

“Of this, BPCL privatisation and LIC listing itself were important contributors. There are estimates suggesting Rs 75,000-80,000 crore or even higher can just come from the privatisation of BPCL itself. LIC IPO could bring in Rs 1 lakh crore approximately,” he said.

The government is selling its entire 52.98 per cent stake in BPCL in the nation’s biggest privatisation till date. Vedanta Group and private equity firms Apollo Global and I Squared Capital’s Indian unit Think Gas have put in an expression of interest for buying the government’s stake.

With regard to LIC’s listing, the government has already got amendments in the LIC Act passed through Finance Bill 2021 in Parliament earlier this week.

“These are numbers (disinvestment) which are imminently achievable because the work had begun on many of these and they will be completed in FY’22,” he said.

Recalling Prime Minister Narendra Modi’s statement on privatisation, he said these are signature changes that are happening.

Prime Minister Modi had last month said the government has no business to be in business and his administration is committed to privatising all PSUs barring the bare minimum in four strategic sectors.

Subramanian also emphasised that India needs a lot more banks for meeting its growth potential.

Citing an example of the US, he said America which has one-third the population of India has about 25,000-30,000 banks.

On the long-term growth story of India, he said the economy is expected to record double digit growth next financial year.

During 2022-23, it could moderate to 6.5-7 per cent and thereafter 7.5-8 per cent, aided by the reform measures announced by the government recently, he added.

PTI