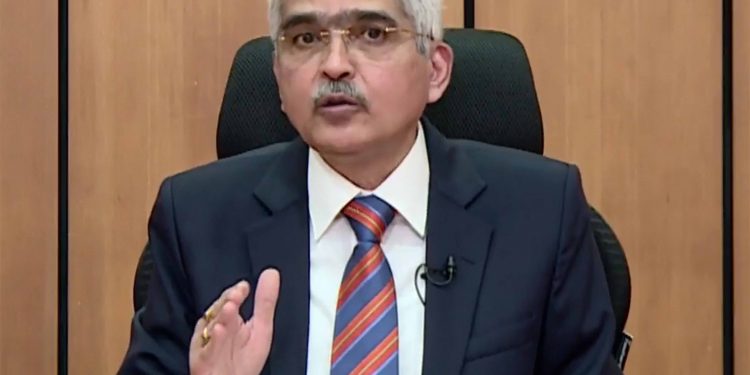

Chennai: Reserve Bank of India (RBI) Governor Shaktikanta Das Saturday said the central bank remains steadfast to take any further measures as may be required to support growth without compromising on financial stability.

Delivering the 39th Palkhivala Memorial Lecture, the governor said the principal objective during the pandemic period was to support economic activity; and looking back, it is evident that policies of the RBI have helped in easing the severity of the economic impact of the pandemic.

“I would like to unambiguously reiterate that the Reserve Bank remains steadfast to take any further measures, as may be necessary, while at the same time remaining fully committed to maintaining financial stability,” he said.

In a bid to maintain financial stability, Das emphasised the need for banks to raise resources in advance as a buffer.

Going ahead, he said, financial institutions in India have to walk a tightrope in nurturing the economic recovery within the overarching objective of preserving long-term stability of the financial system.

The current COVID-19 pandemic related shock will place greater pressure on the balance sheets of banks in terms of non-performing assets, leading to erosion of capital, he said, adding building buffers and raising capital by banks – both in the public and private sector – will be crucial not only to ensure credit flow but also to build resilience in the financial system.

“We have advised all banks, large non-deposit taking NBFCs and all deposit-taking NBFCs to assess the impact of COVID-19 on their balance sheet, asset quality, liquidity, capital adequacy, and work out possible mitigation measures, including capital planning, capital raising, and contingency liquidity planning, among others,” he said.

Prudently, a few large public sector banks (PSBs) and major private sector banks (PVBs) have already raised capital, and some have plans to raise further resources taking advantage of benign financial conditions.

“This process needs to be put on the fast track,” he added.

The governor said recent experience across countries during the pandemic suggest that banks, non-banks, financial markets and payment systems remain at the core of financial stability issues, there was a need to work much closer at the system in its entirety.

“In this sense, the overall objective of financial stability policies should be closely intertwined with the health of the real economy,” he noted.

The financial stability needs to be seen in a broader perspective and must include not just the stability of the financial system and price stability but also ‘fiscal sustainability and external sector viability’, Das said.

Noting that good governance will have to be supported by effective risk management functions and assurance mechanisms, he said banks and non-banking finance institutions need to identify risks early, monitor them closely and manage them effectively.

“The risk management function in banks and NBFCs should evolve with changing times as technology becomes all-pervasive and should be in sync with international best practices. In this context, instilling an appropriate risk culture in the organisation is important,” he said.

A robust assurance mechanism by way of internal audit function was another important component of sound corporate governance and risk management, Das said, adding it provides independent evaluation and assurance to the Board that the “operations were performed in accordance with set policies and procedures”.

He said the central bank has already taken a number of measures and would continue to do so.

“Recent efforts in this direction were geared towards enhancing the role and stature of compliance and internal audit functions in banks by clarifying supervisor expectations and aligning the guidelines with best practices.

“Some more measures on improving governance in banks and NBFCs are in the pipeline,” he said.

PTI