RBI refrains from giving growth, says current GDP projections at risk

Mumbai: The Reserve Bank of India (RBI) refrained Friday from making any projections for growth and inflation. It said the performance of these two key macroeconomic parameters in the days ahead would depend upon the intensity, spread and duration of COVID-19.

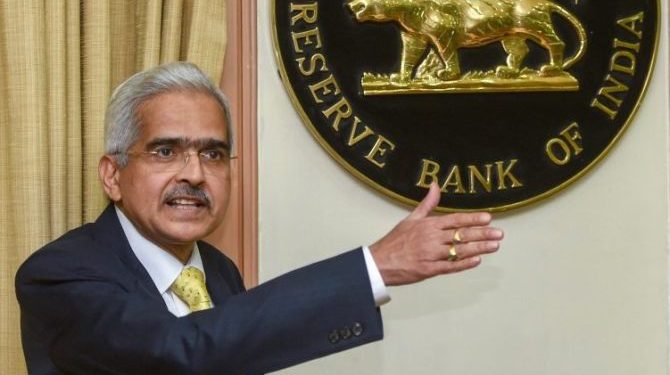

Announcing the decisions of the Monetary Policy Committee (MPC), RBI Governor Shaktikanta Das said that no projection for growth and inflation is being given in view of the uncertainty created by outbreak of the deadly novel coronavirus.

Das further said that the growth projection of 4.7 per cent for the fourth quarter of 2019-20 and five per cent for the whole fiscal was ‘at risk’.

On the global economy, the governor said that slowdown could deepen impacting the growth prospects everywhere in the world. As regards India, Das said: “Growth and inflation would be contingent on intensity, spread and duration of COVID-19.”

In another development the RBI asked all lending institutions to allow three-month moratorium on EMI payments in order to infuse liquidity into the system as the economy grapples with COVID-19 challenges. It has also allowed banks for deferment of interest on working capital loans for the next three months – until June 2020.

The liquidity measures announced by the RBI will make available a total Rs 3,74,000 crore to the country’s financial system. Das stated that the deferment on loan and interest repayments will not be classified as defaults and will not impact credit history of borrowers.

The RBI has also allowed banks to participate in offshore non-deliverable forward (NDF) rupee markets with a view to contain volatility in the domestic currency.

It can be noted that the ongoing financial market volatilities triggered by coronavirus outbreak dragged the rupee to touch lifetime lows and also breach the 75-mark against the US dollar before gaining some lost ground in the last few days.

In the past, experts have expressed concern about the NDF market – till now inaccessible to Indian banks – as among the measures which drive the rupee movement.

“…the time is apposite to remove segmentation between the onshore and offshore markets and improve efficiency of price discovery,” Das told the media.

The measure is aimed at improving depth and price discovery in the forex market segments by reducing arbitrage between onshore and offshore markets, Das added.

Meanwhile interest-rate sensitive bank, realty and auto shares Friday gained up to 12.40 per cent after the RBI cut benchmark interest rate by 75 basis points to deal with the hardship caused due to the outbreak of COVID-19.

Shares of Axis Bank were trading higher by 12.40 per cent, IndusInd Bank 6.25 per cent, State Bank of India 5.19 per cent, Federal Bank 4.55 per cent, ICICI Bank 2.61 per cent, RBL Bank 2 per cent, Kotak Mahindra Bank 1.47 per cent and HDFC Bank 0.21 per cent.

Led by rise in these companies, the BSE Bankex rose by 4.12 per cent.

The RBI cut benchmark interest rate by 75 basis points to 4.4 per cent. The central bank also reduced the cash reserve ratio (CRR) of all banks by 100 basis points to three per cent with effect from March 28 for 1 year.

PTI